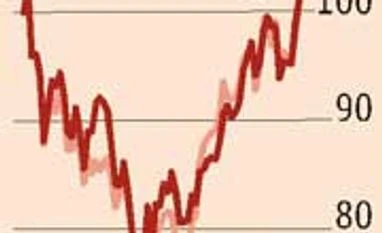

Experts are pushing for Tata Motors' differential voting rights (DVR) shares as a low-beta option for exposure in the country's biggest automobile firm.

Large MFs face a tough time

After aggressively pitching for transparency and reduction in costs, large mutual fund houses are suddenly finding themselves in a spot. With the Securities and Exchange Board of India asking fund houses to provide data on commissions paid, and report other expenses, such as taking distributors abroad, most feel disclosures have increased substantially. Sectoral sources say many top fund houses have come together to send a list of disclosures they are comfortable with to the Sebi for consideration. Meanwhile, the Association of Mutual Funds in India is engaging with the distributor community actively to soothe frayed nerves.

Sharepro scam spreads further?

The Sharepro Services scam has taken a worrying turn. In its initial probe, the Securities and Exchange Board of India (Sebi) found the scam could also involve a depository. Sources said an official with one of the depositories was linked to prime accused Indrani Karkera, vice-president, Sharepro, a registrar and transfer agent. While Sebi has asked the depository for an audit report, the official concerned has been suspended. Sharepro and 15 of its officials have been barred from the securities market after Sebi's preliminary findings showed Rs 21 crore was transferred illegally to entities related to Karkera.

Samie Modak

Large MFs face a tough time

After aggressively pitching for transparency and reduction in costs, large mutual fund houses are suddenly finding themselves in a spot. With the Securities and Exchange Board of India asking fund houses to provide data on commissions paid, and report other expenses, such as taking distributors abroad, most feel disclosures have increased substantially. Sectoral sources say many top fund houses have come together to send a list of disclosures they are comfortable with to the Sebi for consideration. Meanwhile, the Association of Mutual Funds in India is engaging with the distributor community actively to soothe frayed nerves.

Joydeep Ghosh

Sharepro scam spreads further?

The Sharepro Services scam has taken a worrying turn. In its initial probe, the Securities and Exchange Board of India (Sebi) found the scam could also involve a depository. Sources said an official with one of the depositories was linked to prime accused Indrani Karkera, vice-president, Sharepro, a registrar and transfer agent. While Sebi has asked the depository for an audit report, the official concerned has been suspended. Sharepro and 15 of its officials have been barred from the securities market after Sebi's preliminary findings showed Rs 21 crore was transferred illegally to entities related to Karkera.

Shrimi Choudhary

)