A few sessions, they say, is a long time for the markets. Barely a fortnight earlier, it was all gloom and doom, with fear of the US Federal Reserve’s tapering of its $85 billion monthly bond buying programme, amid heightened geopolitical tensions in West Asia that sent crude oil prices flaring.

It was a double whammy for the Indian markets, also reeling under a sliding rupee and a widening current account deficit (CAD).

U-turn

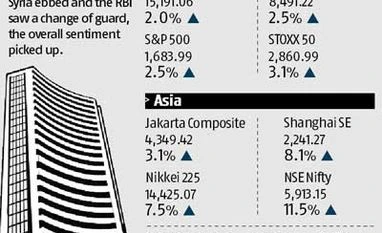

Come September, suddenly everything started falling in place. While concerns and war clouds have ebbed, a change of guard at the Reserve Bank of India (RBI) which saw a slew of measures announced to stem the rupee’s fall lifted overall sentiment. The trade deficit declined 23 per cent in August to $10.9 billion from $14.2 billion in the corresponding month last year and down 11 per cent month-on-month. August also saw car sales surge for the first time in 10 months. On its part, the government got a few key Bills passed in the monsoon session of Parliament.

Since August 21 when the benchmark indices hit their respective lows of 17,906 (S&P BSE Sensex) and 5,302.55 (CNX Nifty), the Indian markets have risen nearly 12 per cent.

Point out Rakesh Arora and Arjun Bhattacharya of Macquarie Research: “The sharp bounceback in the (Indian) market is akin to the one after P Chidambaram took over as finance minister.”

While the US markets were up on positive macro data, China’s markets also witnessed decent returns on improved manufacturing activity.

Road ahead

But is this some kind of misplaced hope that the market is placing on the new governor? Will the market rally sustain this time and is the worst behind us?

“I don’t see why the markets should trade at significantly higher from the current levels. There are a number of challenges facing the economy. There are changes on the policy front but these are not sufficient to propel the market to completely new levels. We need a lot more cohesion than what is visible. In addition, the country is heading into an election mode. At the global level, there is a fear of tapering of the US bond buying programme. All this is likely to keep sentiment in check,” said Raamdeo Agrawal, joint managing director, Motilal Oswal Financial Services.

Arora and Bhattacharya of Macquarie opine the bounce-back in equities might be short-lived, as economic data continues to be weak, uncertainty around QE still persists and the earnings season next month is likely to disappoint.

“More clarity on RBI’s stance and the direction of future monetary policy would go a long way in instilling confidence in the markets. Valuations look tempting but the macro environment looks fraught with headwinds. We advise caution,” they suggest.

“We’ve had a Rajan (new RBI governor) relief rally over the past few days, with the panic thankfully subsiding. But sustaining and building on it will be difficult. And, with so many macro risks around, volatility is here to stay. The markets have so many macro issues to navigate,” said Nick Paulson-Ellis, country head (India), Espírito Santo Securities.

Adding: “And, last but not least, the market has to navigate a growth outlook where visibility is unusually poor. In the near term, the most important factor is achieving stability in the rupee, and that can only happen once the (US Fed’s) tapering outcome is clearer,” he adds.

“The economic slowdown is clearly turning out to be longer than anyone had anticipated. Concerns about premature tapering by the US Fed have led to an environment of low liquidity that seems likely to continue for the foreseeable horizon. In this environment, not only could earnings estimates suffer more than we had expected but target valuations could also decline on account of a higher cost of capital. Combining these drivers, we cut our December 2013 Sensex target by 21 per cent, to 17,000,” said Manishi Raychaudhuri, Asia-Pacific Strategist at BNP Paribas.

It was a double whammy for the Indian markets, also reeling under a sliding rupee and a widening current account deficit (CAD).

U-turn

Come September, suddenly everything started falling in place. While concerns and war clouds have ebbed, a change of guard at the Reserve Bank of India (RBI) which saw a slew of measures announced to stem the rupee’s fall lifted overall sentiment. The trade deficit declined 23 per cent in August to $10.9 billion from $14.2 billion in the corresponding month last year and down 11 per cent month-on-month. August also saw car sales surge for the first time in 10 months. On its part, the government got a few key Bills passed in the monsoon session of Parliament.

Since August 21 when the benchmark indices hit their respective lows of 17,906 (S&P BSE Sensex) and 5,302.55 (CNX Nifty), the Indian markets have risen nearly 12 per cent.

Point out Rakesh Arora and Arjun Bhattacharya of Macquarie Research: “The sharp bounceback in the (Indian) market is akin to the one after P Chidambaram took over as finance minister.”

While the US markets were up on positive macro data, China’s markets also witnessed decent returns on improved manufacturing activity.

Road ahead

But is this some kind of misplaced hope that the market is placing on the new governor? Will the market rally sustain this time and is the worst behind us?

“I don’t see why the markets should trade at significantly higher from the current levels. There are a number of challenges facing the economy. There are changes on the policy front but these are not sufficient to propel the market to completely new levels. We need a lot more cohesion than what is visible. In addition, the country is heading into an election mode. At the global level, there is a fear of tapering of the US bond buying programme. All this is likely to keep sentiment in check,” said Raamdeo Agrawal, joint managing director, Motilal Oswal Financial Services.

Arora and Bhattacharya of Macquarie opine the bounce-back in equities might be short-lived, as economic data continues to be weak, uncertainty around QE still persists and the earnings season next month is likely to disappoint.

“More clarity on RBI’s stance and the direction of future monetary policy would go a long way in instilling confidence in the markets. Valuations look tempting but the macro environment looks fraught with headwinds. We advise caution,” they suggest.

“We’ve had a Rajan (new RBI governor) relief rally over the past few days, with the panic thankfully subsiding. But sustaining and building on it will be difficult. And, with so many macro risks around, volatility is here to stay. The markets have so many macro issues to navigate,” said Nick Paulson-Ellis, country head (India), Espírito Santo Securities.

Adding: “And, last but not least, the market has to navigate a growth outlook where visibility is unusually poor. In the near term, the most important factor is achieving stability in the rupee, and that can only happen once the (US Fed’s) tapering outcome is clearer,” he adds.

“The economic slowdown is clearly turning out to be longer than anyone had anticipated. Concerns about premature tapering by the US Fed have led to an environment of low liquidity that seems likely to continue for the foreseeable horizon. In this environment, not only could earnings estimates suffer more than we had expected but target valuations could also decline on account of a higher cost of capital. Combining these drivers, we cut our December 2013 Sensex target by 21 per cent, to 17,000,” said Manishi Raychaudhuri, Asia-Pacific Strategist at BNP Paribas.

)