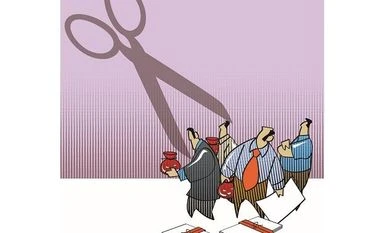

The government’s intention to tap foreign savings is not very difficult to understand. According to the latest data, net household financial savings dropped to an eight-year low of 6.5 per cent of gross domestic product (GDP) in 2018-19. It is likely that household financial savings are at similar levels, which are not sufficient to fund the needs of both the government and the corporate sector. Total public sector borrowing itself is said to be at around 9 per cent of GDP. The decline in savings is putting upward pressure on interest rates, which is being reflected in the bond market. The flow of foreign savings would ease some pressure in the debt market and help encourage real investments. The government is also increasing the limit for foreign investment in the corporate debt market.

However, things will not be this easy and straightforward. There are well-grounded reasons why policymakers in the past resisted opening up the debt market to foreign investors beyond a point. In the given context, it is likely that India will not immediately get included in bond indices and would need to offer a significant stock of bonds to foreign investors before being considered for addition in indices. Inclusion in such indices often depends on availability and liquidity. But large foreign inflows will put upward pressure on the rupee, which could affect India’s external competitiveness and increase the current account deficit. To avoid currency appreciation, the Reserve Bank of India will need to actively manage the currency, which could affect its monetary policy objectives. In fact, the Indian central bank had to make large interventions in 2019, which has resulted in surplus liquidity in the system at a time when inflation has gone above the upper end of the target band. Availability of foreign funds could also reduce bond market pressure in the short run and encourage the government to increase spending. This can pose financial stability risks in the medium to long term. The government is already running a fiscal deficit of well over 4 per cent of GDP, once the extra budgetary spending is added, and is mostly being used to fund consumption expenditure.

Thus, while the idea of inclusion in global bond indices and accessing global savings has merits at a theoretical level, policymakers should not ignore the fundamental weaknesses of the Indian economy. Some of the reasons such as the persistently high fiscal deficit and weaknesses in the financial system discouraged policymakers in the past from opening up the capital account. These weaknesses still exist. Therefore, it is important to first strengthen the fundamentals of the economy. Increasing dependence on foreign flows with weak fundamental could raise financial stability risks.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)