The Union Cabinet's nod to the National Offshore Wind Energy Policy opens new opportunities for wind mill manufacturers in the country. The 20-22 Giga watt (Gw) offshore opportunities, to be explored now, will help in achieving the 60-Gw wind energy target by 2022 set by the government.

Offshore projects are expected to be more lucrative as compared to onshore ones, given higher capacity utilisation. Tulsi Tanti, chairman, Suzlon Group, says one of the key advantages of offshore wind energy is that large-sized projects of 1,000 Mw and above can be built with capacity utilisation ranging from 45-50 per cent. The onshore projects capacity utilisation is close to 25 per cent.

Sandeep Upadhyay MD & CEO - Centrum Infrastructure Advisory, says the Cabinet's nod is an encouraging step. However, for commercial success of offshore projects, the government will have to ensure consistent policy framework, including sustainable tariff guidelines, he adds. The key risks that analysts have continued to highlight are potential regulatory changes and weak state electricity board finances impacting their ability to buy wind power, which is expensive compared to conventional energy sources.

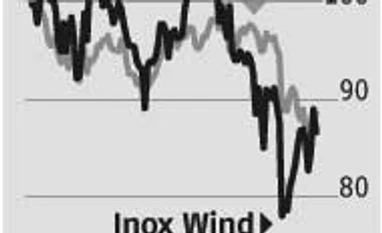

Among the listed players, the focus shifts to Suzlon Energy and Inox Wind which can benefit from the growing investments and new projects in the wind energy sector.

While there were debt concerns for Suzlon, post-financial restructuring, equity issuance to Dilip Shanghvi and Associates and the Senvion (formerly REpower Systems) sell-off, it has been able to cut debt substantially. Its operations are focussed on India, where it is eyeing new order wins and execution to get back its lost market share. Analysts at Nomura who see an upside of about 76 per cent for the stock from current market price of Rs 21.65 (target price Rs 38) say Suzlon is a potential turnaround story in the emerging wind power sector in India, where it has traditionally been a market leader due to its strong end-to-end engineering procurement construction and operations and maintenance capability.

Inox Wind, too, remains well-placed to gain from the opportunities. Bank of America Merrill Lynch estimates annual earnings per share growth of 65 per cent over FY15-17 and return on equity of 35 per cent in FY17.

Offshore projects are expected to be more lucrative as compared to onshore ones, given higher capacity utilisation. Tulsi Tanti, chairman, Suzlon Group, says one of the key advantages of offshore wind energy is that large-sized projects of 1,000 Mw and above can be built with capacity utilisation ranging from 45-50 per cent. The onshore projects capacity utilisation is close to 25 per cent.

Sandeep Upadhyay MD & CEO - Centrum Infrastructure Advisory, says the Cabinet's nod is an encouraging step. However, for commercial success of offshore projects, the government will have to ensure consistent policy framework, including sustainable tariff guidelines, he adds. The key risks that analysts have continued to highlight are potential regulatory changes and weak state electricity board finances impacting their ability to buy wind power, which is expensive compared to conventional energy sources.

Among the listed players, the focus shifts to Suzlon Energy and Inox Wind which can benefit from the growing investments and new projects in the wind energy sector.

While there were debt concerns for Suzlon, post-financial restructuring, equity issuance to Dilip Shanghvi and Associates and the Senvion (formerly REpower Systems) sell-off, it has been able to cut debt substantially. Its operations are focussed on India, where it is eyeing new order wins and execution to get back its lost market share. Analysts at Nomura who see an upside of about 76 per cent for the stock from current market price of Rs 21.65 (target price Rs 38) say Suzlon is a potential turnaround story in the emerging wind power sector in India, where it has traditionally been a market leader due to its strong end-to-end engineering procurement construction and operations and maintenance capability.

Inox Wind, too, remains well-placed to gain from the opportunities. Bank of America Merrill Lynch estimates annual earnings per share growth of 65 per cent over FY15-17 and return on equity of 35 per cent in FY17.

)