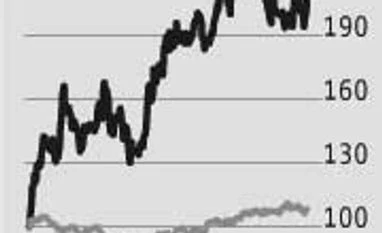

Share prices of sugar companies have come off the peaks seen in July-August. Though domestic sugar prices remain firm and international prices are at multi-month highs, the correction in share price is a result of government intervention to cap further price rise. There are also concerns on sugarcane pricing, especially in Uttar Pradesh.

Nevertheless, experts say firms’ profitability will remain good because of low buffer stocks being carried forward and likely decline in production next year (October-September). CARE Ratings said the medium-term outlook for the industry remains stable because of favourable developments in 2015-16.

Analysts, thus, say the correction is a good opportunity to enter companies with good balance sheets such as Balrampur Chini and EID Parry. Amongst mid-caps, analysts are positive on Dalmia Bharat and Dhampur Sugar.

While these could have caused a temporary blip, Indian Sugar Mills Association (Isma) data issued on September 28 indicate that prices may not fall substantially. Production in 2016-17 is estimated at 23.4 million tonnes (much below the 26 mt in 2015-16). With consumption estimated at 25.6 mt and opening balance of about 7.5 mt, it will lead to lower inventories.

Abinash Verma, director general of Isma, says the equation is balanced and prices are to stay above the cost of production. Experts also suggest that the government is unlikely to take harsh measures given that the industry has just started to recover from its debt problem.

Analysts at Axis Capital say the industry will continue to benefit from firm prices for the next 18-24 months, given that stock is at an all-time low. With firm global prices, landed cost of imported sugar is currently at Rs 40 a kg against domestic prices of Rs 35 a kg, leaving headroom for upside. They are positive on Dalmia Bharat, which they feel is uniquely positioned to capitalise on the tailwinds.

In general, analysts remain positive on UP-based players as they feel cane availability in the state will be higher and also that improving recovery rates will add to gains. Balrampur Chini remains best placed to gain from this and is amongst the top picks. Analysts at LKP Securities say the company is the best proxy to ride on sugar sector revival.

Nevertheless, experts say firms’ profitability will remain good because of low buffer stocks being carried forward and likely decline in production next year (October-September). CARE Ratings said the medium-term outlook for the industry remains stable because of favourable developments in 2015-16.

Analysts, thus, say the correction is a good opportunity to enter companies with good balance sheets such as Balrampur Chini and EID Parry. Amongst mid-caps, analysts are positive on Dalmia Bharat and Dhampur Sugar.

While these could have caused a temporary blip, Indian Sugar Mills Association (Isma) data issued on September 28 indicate that prices may not fall substantially. Production in 2016-17 is estimated at 23.4 million tonnes (much below the 26 mt in 2015-16). With consumption estimated at 25.6 mt and opening balance of about 7.5 mt, it will lead to lower inventories.

Abinash Verma, director general of Isma, says the equation is balanced and prices are to stay above the cost of production. Experts also suggest that the government is unlikely to take harsh measures given that the industry has just started to recover from its debt problem.

Analysts at Axis Capital say the industry will continue to benefit from firm prices for the next 18-24 months, given that stock is at an all-time low. With firm global prices, landed cost of imported sugar is currently at Rs 40 a kg against domestic prices of Rs 35 a kg, leaving headroom for upside. They are positive on Dalmia Bharat, which they feel is uniquely positioned to capitalise on the tailwinds.

In general, analysts remain positive on UP-based players as they feel cane availability in the state will be higher and also that improving recovery rates will add to gains. Balrampur Chini remains best placed to gain from this and is amongst the top picks. Analysts at LKP Securities say the company is the best proxy to ride on sugar sector revival.

)