The June 2016 quarter (Q1) results broke the jinx of falling revenues for NTPC. Revenues, which were on a declining mode for at least eight quarters, saw some breather in Q1, and expanded 11.5 per cent at Rs 19,063 crore - exceeding Bloomberg estimate of Rs 18,514 crore.

Given that revenue growth is on the back of convincing operational factors such as improvement in plant load factor (PLF or plant capacity utilisation), analysts give a thumbs-up to the Q1 results. Helped by benign coal prices, raw material cost increased by only a per cent, though raw material cost as a percentage of sales declined to 61 per cent in Q1 from 67 per cent in the year-ago period. This has helped operating margins expand to 27 per cent (up 660 basis points year-on-year).

However, net profit grew at a crawling pace of four per cent year-on-year (Rs 2,369 crore). Higher interest expenses (up 20 per cent year-on-year to Rs 900 crore in Q1) and tax outgo, which was higher than previous year's figures contained any meaningful improvement in net profit.

Management commentary, which until recently was cautious, took an optimistic tone in Q1 helped by higher PLF.

Thermal PLF (consolidated) stood at 63.56 per cent - an improvement of 140 basis points year-on-year. On a standalone basis (majority of revenues), NTPC's PLF saw a steeper improvement to 81.35 per cent from 77.58 per cent a year ago. What's comforting is that this improvement appears sustainable given that coal availability is at comfortable levels.

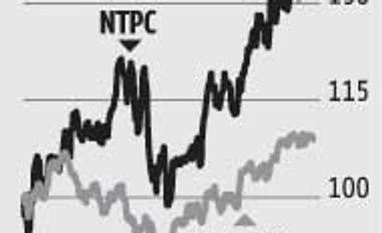

"Unless issues such as maintenance crop up, which could impact generation, the higher PLF appears sustainable," says Sanjeev Zarbade of Kotak Securities. Likewise, the trend of falling fuel cost (coal) - from Rs 2.1 per unit a year ago to Rs 1.9 per unit in Q1 is also expected to stay. After the results, two out of three analysts polled on Bloomberg retain their 'buy' recommendation on the stock. However, given the 20 per cent run-up in its stock price since May, Zarbade advises investors to buy NTPC's scrip on decline.

Given that revenue growth is on the back of convincing operational factors such as improvement in plant load factor (PLF or plant capacity utilisation), analysts give a thumbs-up to the Q1 results. Helped by benign coal prices, raw material cost increased by only a per cent, though raw material cost as a percentage of sales declined to 61 per cent in Q1 from 67 per cent in the year-ago period. This has helped operating margins expand to 27 per cent (up 660 basis points year-on-year).

However, net profit grew at a crawling pace of four per cent year-on-year (Rs 2,369 crore). Higher interest expenses (up 20 per cent year-on-year to Rs 900 crore in Q1) and tax outgo, which was higher than previous year's figures contained any meaningful improvement in net profit.

Management commentary, which until recently was cautious, took an optimistic tone in Q1 helped by higher PLF.

Thermal PLF (consolidated) stood at 63.56 per cent - an improvement of 140 basis points year-on-year. On a standalone basis (majority of revenues), NTPC's PLF saw a steeper improvement to 81.35 per cent from 77.58 per cent a year ago. What's comforting is that this improvement appears sustainable given that coal availability is at comfortable levels.

"Unless issues such as maintenance crop up, which could impact generation, the higher PLF appears sustainable," says Sanjeev Zarbade of Kotak Securities. Likewise, the trend of falling fuel cost (coal) - from Rs 2.1 per unit a year ago to Rs 1.9 per unit in Q1 is also expected to stay. After the results, two out of three analysts polled on Bloomberg retain their 'buy' recommendation on the stock. However, given the 20 per cent run-up in its stock price since May, Zarbade advises investors to buy NTPC's scrip on decline.

)