The Reserve Bank of India's (RBI) next policy statement is on April 5. Consensus favours a rate cut. This is already priced into market action. The data in favour of a cut would seem to be fairly compelling. If you take the combination of weak manufacturing trends, lower-than-expected inflation and an overvalued rupee, a rate cut certainly seems obvious.

Manufacturing remains in the doldrums since the Index of Industrial Production (IIP) has seen negative year-on-year (YoY) changes for three months in a row (November 2015-January 2016). Inflation is down for February 2016. The Consumer Price Index (CPI) saw YoY change of 5.18 per cent, which was lower than January 2016 (5.69 per cent) and also lower than consensus estimates. The Wholesale Price Index (WPI) for February saw negative YoY change for the 16th month in a row. Exports also fell, for the 15th month in succession. The RBI's real Effective Exchange Rate calculations indicate that the rupee is overvalued against a trade-weighted basket of 36 currencies.

The US Federal Open Markets Committee was decidedly dovish. The Fed is cutting growth and inflation estimates while holding to its belief that "moderate economic expansion" will continue. The chairperson, Janet Yellen, said that "caution is appropriate". The market interprets this to mean that the Fed is not likely to hike the policy rate more than twice in 2016. The USD plunged and gold went into a speculative rally.

Meanwhile, China's slowdown continues to cause concern. The data for January and February are clubbed together due to the Chinese New Year. Retail sales and industrial output rose 10.2 per cent and 5.4 per cent year-on-year, respectively, and both numbers were well below consensus expectations.

The rupee has gained nearly three per cent versus USD since the Budget. It has gained 1.5 per cent against the yen. But it has actually lost ground versus the Euro (down 0.29 per cent) and the GBP (down 1.18 per cent). The strength versus the USD is partly due to inflows from foreign portfolio investors (FPI). Interestingly, FPIs have bought equity in huge quantities while being moderate net sellers in rupee debt. The bond selling is a little puzzling, given expectations of an RBI rate cut.

Apart from the Budget itself, sentiment has revived to some extent because there appears to be progress on the ground in terms of reviving stalled projects. Protectionist measures should also enable the domestic steel industry to turn around. The UDAY (Ujwal Discom Assurance Yojana) programme buys some time at least for the debt-laden power sector.

On the legislative front, the passage of the Real Estate Bill and the Aadhaar Bill have been taken as positive signals. There are major privacy concerns with Aadhaar. But the passage in itself is being taken as a sign that the government may be able to break the logjam in Parliament.

The GST (Goods and Services Tax) remains stuck however. That has constitutional implications and, therefore, cannot be passed as a money bill. There are rumours that there will be an attempt to pass GST in the second half of the Budget session and if that does happen, the market will see it as a very positive development.

On the negative side of the ledger the banning of many fixed dose combination drugs has dealt a body blow to the pharmaceuticals industry. This hurts a key "perennial" sector. It has hurt sentiment as highly-valued pharma stocks have taken a beating.

In other bad news, global crude prices have also rebounded substantially, moving back above $42/barrel for Brent. Consumer inflation could spike again as retail fuel prices have just been hiked. Unseasonal rain and hail will also cause some crop losses in north India, and that might also push up food prices. This might just give the RBI some reason to hold off.

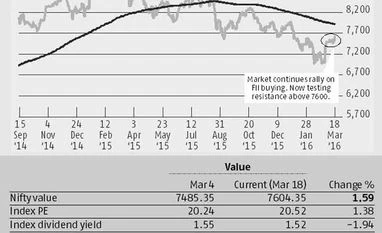

It remains to be seen how much political resistance there will be to the cut in the Public Provident Fund rates although it appears a rational move. The initial public offering of Infibeam will be an useful indicator of sentiment in the primary market since the company is in a "hot" sector. In the secondary market, the rally continues though the momentum has slowed. The next major resistances could be at around the level of the 200-Day Moving Averages.

)