The repo drops to 6.75 per cent and commercial rates are set to move down. In all probability, India's banks will not pass on the entire cut. The three prior cuts, amounting to a total of 75 basis points, have not been passed on in full. Banks have cut rates by a median of about 30 basis points. Nevertheless, even if this cut is not fully transmitted, interest rates should ease appreciably. The bond market has already responded with government security yields sliding.

It must be noted that the RBI is cutting rate because it is pessimistic about growth prospects, rather than sanguine about inflation. The monetary policy statement was largely doom and gloom. The RBI is cutting as a counter-cyclical measure (and possibly to ensure that the rupee weakens).

The statement lists a litany of worries. Global growth has slowed, "downside risks have increased". Emerging markets have been hit by slowing trade. China's rebalancing of its growth from being investment-driven to being consumption-led is being hit by the stockmarket meltdown. Brazil and Russia are struggling to cope with inflation. Depressed commodity prices threaten other regions with deflation. China's devaluation has had an unsettling effect. India will probably see the current account deficit widening a little.

"Overall financial conditions are yet to stabilise". The central bank says India's economic recovery is tentative. Monsoon failure, poor rural demand, "persistent drag from lower exports and cheaper imports", etc, all mean that the RBI has cut its estimates of domestic GDP growth marginally, from 7.6 per cent to 7.4 per cent. It estimates that inflation on the Consumer Price Index will be up 5.8 per cent year-on-year by January 2016. The August 2015 CPI was up 3.66 per cent versus August 2014. But favourable base effects will cease because crude prices dropped sharply in September 2014.

The RBI's sombre tone was backed up by similar pessimistic statements from the IMF and the US Federal Reserve. The IMF thinks global growth will weaken in 2016, while Janet Yellen reiterated that the Fed would in all probability, raise the USD Fed Fund rate before January 2016.

Given Chinese devaluation and measures taken by central banks in other emerging markets, the RBI's cut might just weaken the rupee by enough to keep India's exports from collapsing. Amidst other EM currency devaluations, Malaysia's ringgit has seen its steepest quarterly fall since 1997 while Brazil's real has hit record lows and South Africa's rand has hit a four year low. The rupee has to fall. There is no other reasonable way to maintain some export competitiveness or to protect the domestic economy from a flood of cheap imports.

For what it's worth, India apparently outscored the US and China in terms of FDI (Foreign Direct Investment) inflows between January-June 2015. A report from the Financial Times of London says India logged over $31 billion of FDI in that six month period, while China saw inflows of $28 billion and the US saw FDI inflows of $27 billion. However, the FT numbers are puzzling. The RBI estimates FDI at about $18.9 billion for that same period and the Department of Industrial Policy and Promotion in the commerce ministry estimates FDI at $19.4 billion. The other heartening titbit of data is that India has moved up 16 places in the Global Competitiveness Index to #55.

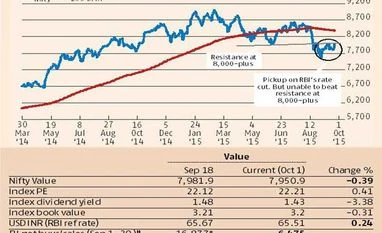

FDI may be up but FII attitude has been dismaying. There were massive selloffs through Q2, 2015-16, in the equity segment although FII are still very net positive for the calendar year. FII debt inflows have been around Rs 39,000 crore since January 2015, while net equity inflows are about Rs 21,000 crore. Domestic institutions have been able to put a fair amount of money into the stock market but this has only just balanced the FII sales. Investor sentiment in Europe and the US has been hit by the Volkswagen scandal. That has triggered a flight to safety away from unrelated assets like Indian equity.

The Nifty is down 4 per cent since January 2015, and it is down about 13 per cent from the all highs of March 2015. The unexpected extra 25 basis points in the RBI's action may help to reverse the bearish trend of the past six months. Also, of course, better than expected Q2 earnings could certainly help matters along. But as of now, this smells like a bear market, which could continue to trend down.

)