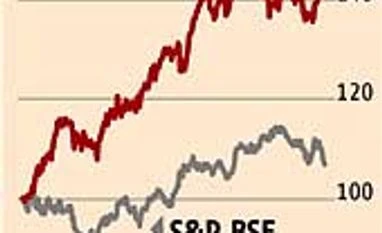

Consumer stocks returned an eye-popping 46 per cent to investors in 2012, while the benchmark gave 26 per cent. As the broader economy started to slow down sharply, consumer companies provided a safe haven to investors, which pushed up the sector's valuations. The sector's 12-month forward price-earnings multiple peaked at a "vertiginous 31x in November 2012" says Espirito Santo. In 2013, the sector showed signs of cooling, but given the political and economic uncertainties, consumer stocks are gaining currency again. But analysts warn that the divergence between consumption growth and overall economic growth is something that's being overlooked.

If the economy is slowing and inflation is stubbornly high, then it will be reflected in consumption, too. This is already visible in the volume growth of most large fast-moving consumer goods companies. With volumes coming under pressure and no significant earnings upgrades, it is apparent that expectations from the sector will be scaled back. Analysts quote IMRB to say the urban consumers are down-trading and cutting back on spends. Skin creams' growth has fallen from 11 per cent in 2010 to zero per cent in 2012. A similar trend is seen in several other categories.

However, there is another segment in the market that believes that consumer companies have increased their reach (through direct distribution) and consumer confidence remains high, especially in rural India. After returning from a field trip to rural Uttar Pradesh, analysts at ICICI Securities are convinced that a silent transformation is happening in rural India. The analysts say: "Rural consumers are speedily adopting premium categories, but ones with intrinsic core benefits: categories like health food drink, feminine hygiene and even diapers are the key beneficiaries."

The brokerage believes Godrej Consumer's stock performance is running ahead of its fundamentals. Colgate Palmolive has corrected nearly 15 per cent after a re-rating. Sector leader HUL too, has seen a de-rating after its weak Q3 numbers. While many believe HUL has taken corrective measures to prevent slide in volumes, most believe others like Nestle have not demonstrated a similar trend. Despite the weakness in the overall market, most brokerages are cautious on consumer stocks.

If the economy is slowing and inflation is stubbornly high, then it will be reflected in consumption, too. This is already visible in the volume growth of most large fast-moving consumer goods companies. With volumes coming under pressure and no significant earnings upgrades, it is apparent that expectations from the sector will be scaled back. Analysts quote IMRB to say the urban consumers are down-trading and cutting back on spends. Skin creams' growth has fallen from 11 per cent in 2010 to zero per cent in 2012. A similar trend is seen in several other categories.

However, there is another segment in the market that believes that consumer companies have increased their reach (through direct distribution) and consumer confidence remains high, especially in rural India. After returning from a field trip to rural Uttar Pradesh, analysts at ICICI Securities are convinced that a silent transformation is happening in rural India. The analysts say: "Rural consumers are speedily adopting premium categories, but ones with intrinsic core benefits: categories like health food drink, feminine hygiene and even diapers are the key beneficiaries."

Also Read

No doubt companies are increasing their presence in different markets through direct distribution, but this is coming at a cost. If marketing spends are any indication, then incremental volume growth is coming at a higher price than before. Hindustan Unilever Ltd (HUL), for instance, spent Rs 743 crore in advertising and promotion to deliver a volume growth of 13 per cent in December 2010. In December 2012, the company spent Rs 822 crore and delivered five per cent volume growth. Espirito Santo Securities says: "As the operating environment becomes more challenging, companies will get more desperate chasing volume growth and in the process hurt earnings instead."

The brokerage believes Godrej Consumer's stock performance is running ahead of its fundamentals. Colgate Palmolive has corrected nearly 15 per cent after a re-rating. Sector leader HUL too, has seen a de-rating after its weak Q3 numbers. While many believe HUL has taken corrective measures to prevent slide in volumes, most believe others like Nestle have not demonstrated a similar trend. Despite the weakness in the overall market, most brokerages are cautious on consumer stocks.

)