Infosys has not only ended FY17 on a disappointing note, with lower-than-expected March quarter performance, albeit marginally, but has also started FY18 on a weaker wicket.

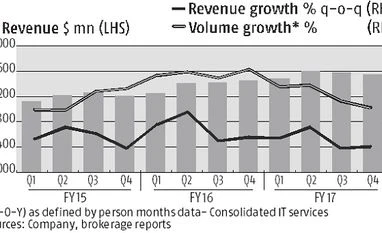

For one, volume growth of 7.74 per cent for the March quarter is almost back to the levels of 7.23 per cent seen in the September 2014 quarter, when Vishal Sikka was brought in as MD and CEO.

Second, Infosys has given an operating profit margin guidance of 23-25 per cent for FY18 compared with 24-25 per cent in FY17 (actual FY17 at 24.7 per cent), leading analysts to downgrade their earnings estimate. The early ones show brokerages have cut net profit estimates for Infosys by three-six per cent. An analyst at a domestic brokerage said the muted revenue growth guidance in constant currency terms at 6.5-8.5 per cent for FY18 was only a slight variation with consensus estimates of 7-9 per cent, but the lower margin guidance had upset the Street. The Infosys stock was the biggest loser in the Sensex, shedding 3.9 per cent on Thursday.

Analysts believe Infosys will achieve revenue growth of 7.5 per cent in FY18, broadly the same (7.4 per cent) that it achieved in FY17. But, multiple headwinds on the margin front such as increasing on-site costs and rupee appreciation are making matters worse. Analysts have cut margins by about 80 basis points, which would take it below 24 per cent in FY18, thereby prompting the cut in earnings. Ashish Chopra, IT analyst at Motilal Oswal Securities, said the weaker margin guidance and March quarter revenue miss drove a three per cent cut in earnings estimates. While there are positive BFSI (banking, financial services and insurance) undertones, it is not reflecting in deals and higher IT budgets in the segment yet; it could come in the second half of FY18, he said. Emkay’s analysts have cut their FY18/19 EPS estimates by four-five per cent each.

The Infosys management, however, indicated the margin band takes into account the lower revenue trajectory, pricing decline and currency volatility. To drive efficiencies, it is looking at higher employee utilisation, lower on-site costs, higher offsite-onsite mix and keeping employee costs steady to drive profitability.

Infosys’s March quarter numbers were below estimates on all counts. Going ahead, the company expects its performance to improve in the US (62 per cent of revenues). It hopes that with rate hikes and expectations of lower regulatory interventions in the US financial sector, the finance vertical (largest vertical, accounting for 33 per cent of revenues) will do better in H2FY18. Given the store closures in the US, the worry is the retail and consumer packaged goods vertical, whose share in overall revenues fell 50 basis points sequentially to 14.1 per cent.

The bigger issue for Infosys is its traditional services business (over half the revenues) are not growing, and newer businesses (digital) are taking time to ramp up. While the company has improved on many fronts such as large deals, client penetration, automation and digital business, in the near-term expect the stock to underperform during this transition to newer business streams, says an analyst.

While clarity on capital allocation (Rs 13,000 crore) for dividends/buybacks helps and would act as a cushion for the stock, it is little solace given the muted growth and margin projection. Moreover, the $20-billion target for 2020, too, seems a bit far-fetched given the FY17 figure of $10.2 billion.

)