Strong performance from the automotive segment is on account of sales of 70,483 vehicles in December 2012, a 36 per cent growth over the previous year. Sequentially too, the company has posted a robust 12.3 per cent growth in September 2012 when it sold 62,751 vehicles. What stands out is that the company has posted strong growth numbers despite increasing competition and slowdown in exports to Sri Lanka, Bangladesh and Bhutan. M&M continues to be the market leader with a lion’s share of 47.9 per cent. However, higher vehicles growth has come at the cost of realisation, which has fallen by 80 basis points, despite the company increasing prices thrice during the year.

Going forward, M&M is hopeful the automotive segment will do well, especially with the launch of premium SUV Rexton from its South Korean arm Ssangyong.

There is little optimism on the farm equipment front where growth was flat. On account of poor winter monsoon in South India, M&M posted flat growth with sales of 62,522 tractors in December 2012, compared to 62,342 last year.

Lower realisation from the automotive segment and poor performance from the farm division led to a fall in operating margin, which slid from 12.2 per cent in December 2011 to 11.2 per cent in December 2012. However, the company was able to post higher net profit on account of lower tax outgo. Effective tax rate fell to 21.1 per cent in December 2012, compared to 27.5 per cent a year ago. At the profit before tax level M&M posted a growth of 15.9 per cent.

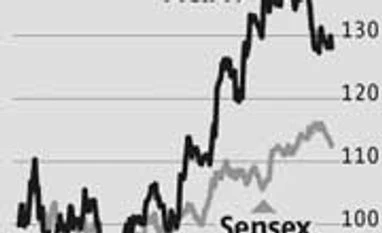

In reaction to its results, M&M shares fell and closed the day at Rs 882.80, down 1.41 per cent over the previous day’s close, though profits were in line with analyst expectations. Unless the company is able to show an all-round performance from both its segments without compromising on operating parameters, the stock can remain under pressure.

)