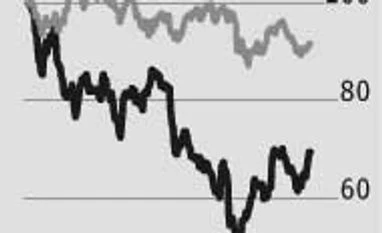

The stock of National Aluminium Company (Nalco) recovered from its 52-week lows in August, gaining 44 per cent to Rs 40.4. The correction in August was on a slide in aluminium prices, cancellation of coal blocks, and subdued demand for metals, but was overdone. Cash and cash-equivalent comes to Rs 21.6 a share and, given intrinsic strengths, one would have expected a bounce-back. The company has since got its coal blocks back and reported a strong performance in the September quarter.

Though the sector outlook may not have changed much, looking at some strength in aluminium premiums, and higher external alumina sales by Nalco, expect some upside. Analysts have pegged target prices at Rs 45 (India Infoline) and Rs 48 (Antique Stock Broking), indicating a 10 per cent upside. Looking at the balance-sheet strength compared to high debt of larger peers Vedanta and Hindalco, it fares better.

Lower coal prices are helping and larger e-auction volumes at lower prices by Coal India will aid Nalco.

Analysts at Antique Stock Broking remain positive on Nalco, given its long alumina position and a firm pricing outlook, though there is softness in LME aluminium prices and physical premiums. Alumina prices as a percentage of LME spot aluminium prices have remained relatively stable. Analysts at IIFL say the company, trading at an estimated 2.8 times the FY17 enterprise value to earnings before interest, depreciation, taxes, and amortisation, is at a huge discount to its historic average and is also lower than its global peers.

Though the sector outlook may not have changed much, looking at some strength in aluminium premiums, and higher external alumina sales by Nalco, expect some upside. Analysts have pegged target prices at Rs 45 (India Infoline) and Rs 48 (Antique Stock Broking), indicating a 10 per cent upside. Looking at the balance-sheet strength compared to high debt of larger peers Vedanta and Hindalco, it fares better.

Lower coal prices are helping and larger e-auction volumes at lower prices by Coal India will aid Nalco.

Analysts at Antique Stock Broking remain positive on Nalco, given its long alumina position and a firm pricing outlook, though there is softness in LME aluminium prices and physical premiums. Alumina prices as a percentage of LME spot aluminium prices have remained relatively stable. Analysts at IIFL say the company, trading at an estimated 2.8 times the FY17 enterprise value to earnings before interest, depreciation, taxes, and amortisation, is at a huge discount to its historic average and is also lower than its global peers.

)