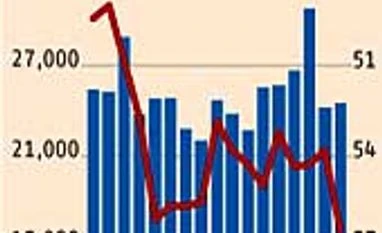

The latest manufacturing purchasing manager's index (PMI) data suggest the rupee depreciation is working its magic on India's manufacturing exports. PMI for new export order rose to 54.4 in June 2013 from 54.04 in May and 51.1 in March this year. The export PMI is now higher than the long-term average at 54.1. This has raised the prospects of a revival in India's merchandise exports and a fall in the trade deficit by the end of the current financial year.

"The rise in the export PMI is a positive indicator for the India's manufacturing export and you can see some uptick in exports in the near term. This would have a positive impact on India's current account deficit (CAD) for FY14 but it will not be big enough to blow away our balance of payment problems," says Sonal Verma, India Economist at Nomura India. According to her, India's export is demand-driven and depends on demand conditions in the destination country; it is only marginally impacted by currency movements.

Some analysts have begun to factor in faster export growth while modelling India's balance of payment for the current financial year. "For FY14, as a whole, we expect the CAD to be around four per cent of GDP against 4.8 per cent last year, on the back of export recovery and some decline in gold imports," say analysts led by Kapil Gupta at Edelweiss Securities, in a recent report.

Historically, manufacturing exports have shown sensitivity to rupee depreciation. In the early 1990s, rupee depreciation was repeatedly used by the government to tame India's CAD that had triggered the 1991 economic crisis. The market-determined depreciation in the rupee seems to be playing a similar role this time and this is what the latest PMI data seem to indicate. This process is likely to play out for at least a few more quarters.

"The rise in the export PMI is a positive indicator for the India's manufacturing export and you can see some uptick in exports in the near term. This would have a positive impact on India's current account deficit (CAD) for FY14 but it will not be big enough to blow away our balance of payment problems," says Sonal Verma, India Economist at Nomura India. According to her, India's export is demand-driven and depends on demand conditions in the destination country; it is only marginally impacted by currency movements.

Some analysts have begun to factor in faster export growth while modelling India's balance of payment for the current financial year. "For FY14, as a whole, we expect the CAD to be around four per cent of GDP against 4.8 per cent last year, on the back of export recovery and some decline in gold imports," say analysts led by Kapil Gupta at Edelweiss Securities, in a recent report.

Also Read

While consumers and manufactures will take time to tweak their shopping and sourcing behaviour in response to the fall in the value of the rupee, the impact is already visible in price-sensitive sectors such as automobile parts and textiles. Textile makers report a similar trend but gains for some companies have been capped due to long-term sourcing agreements with large overseas buyers.

Historically, manufacturing exports have shown sensitivity to rupee depreciation. In the early 1990s, rupee depreciation was repeatedly used by the government to tame India's CAD that had triggered the 1991 economic crisis. The market-determined depreciation in the rupee seems to be playing a similar role this time and this is what the latest PMI data seem to indicate. This process is likely to play out for at least a few more quarters.

)