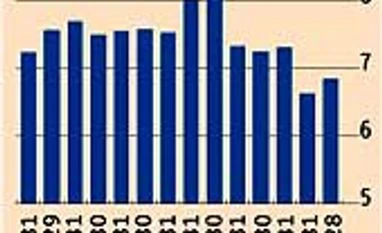

Two different measures of inflation - the consumer price index (CPI) and the wholesale price index (WPI) - in the country are showing a divergence. While CPI continues to stay elevated (up 10.9 per cent in February), the WPI is showing signs of stabilising, with the February print coming in at 6.84 per cent compared to the 6.6 per cent seen in January 2013 and 6.95 per cent seen in February 2012. The divergence between the two indices suggests that the stubbornly high consumer prices are representative of the structural imbalances in the economy, while a cooling WPI is indicative of weak demand and weakening global commodity prices. Manufacturing inflation has surprised positively at 4.5 per cent and core inflation has dipped to 3.8 per cent, which is the lowest since March 2010.

Samiran Chakraborty, regional head of research at Standard Chartered Bank, says, "The challenge is the divergence between the CPI and WPI. While WPI should be stabilising, CPI is stubbornly sticky. Prices of global commodities are reflected in the WPI, especially core inflation, while the structural imbalances are more evident in the CPI." Food is a relatively smaller component in the WIP while it's a significant component in the CPI.

Even though the Reserve Bank of India (RBI), over the past few months, has been keeping a watch on the CPI, any rate action will be influenced by wholesale prices and core inflation. While high food prices are a matter of concern, there's little that RBI can do as food prices are governed by seasonal and supply-demand dynamics. However, the battle against inflation is not completely won. While some believe that the WPI will average at 6.5 per cent in FY14, compared to the 7.5 per cent average seen in FY13, many believe that inflation could spike due to fuel and power price increases. Deutsche Bank believes that the RBI will give more weight to the February WPI outturn and opt for a 25 basis point rate cut in next week's policy. "The window for policy easing could be closing if inflation pressures don't abate further and current account deficit does not improve," it adds.

The fuel price index rose 10.5 per cent in the month after the hikes in LPG and diesel prices. With diesel pricing liberalised, prices will continue to move upwards in times to come, which would put extra pressure on the WPI. All indicators point to a rate cut next week, as RBI has a small window before inflation begins rising.

Samiran Chakraborty, regional head of research at Standard Chartered Bank, says, "The challenge is the divergence between the CPI and WPI. While WPI should be stabilising, CPI is stubbornly sticky. Prices of global commodities are reflected in the WPI, especially core inflation, while the structural imbalances are more evident in the CPI." Food is a relatively smaller component in the WIP while it's a significant component in the CPI.

Even though the Reserve Bank of India (RBI), over the past few months, has been keeping a watch on the CPI, any rate action will be influenced by wholesale prices and core inflation. While high food prices are a matter of concern, there's little that RBI can do as food prices are governed by seasonal and supply-demand dynamics. However, the battle against inflation is not completely won. While some believe that the WPI will average at 6.5 per cent in FY14, compared to the 7.5 per cent average seen in FY13, many believe that inflation could spike due to fuel and power price increases. Deutsche Bank believes that the RBI will give more weight to the February WPI outturn and opt for a 25 basis point rate cut in next week's policy. "The window for policy easing could be closing if inflation pressures don't abate further and current account deficit does not improve," it adds.

The fuel price index rose 10.5 per cent in the month after the hikes in LPG and diesel prices. With diesel pricing liberalised, prices will continue to move upwards in times to come, which would put extra pressure on the WPI. All indicators point to a rate cut next week, as RBI has a small window before inflation begins rising.

)