Imagine the plight of a manufacturer or an importer now. If there are two probable rates of duty for goods he manufactures or imports, there is no way he can avoid getting into litigation.

If he wants to know the correct rate of duty, there is no system by which he can get an authentic ruling. He does not mind paying a higher rate of duty, if there is a final ruling on it.

He may be convinced that the rate of duty to be paid by him is lower (may be on the basis of an expert opinion) but he cannot get an advance ruling which is firm in the sense that the department cannot go against it.

He can neither get an Advance Ruling nor a Board's Ruling. So if he pays a lower rate of duty, he may get into a dispute, which is practically never ending.

I am not writing here about the dispute resolution system, which is in any case cumbrous and heavily loaded against the taxpayer. Data show that 85 per cent or more cases are lost by the Department Gautam Ray in Indian Tax Administration by P Shome at p.178, which means almost all pleas by the taxpayer are simply rejected.

Moreover, the Law of Unjust Enrichment comes handy to the Department to deny refund. The existing provision only makes taxpayers to run from pillar to post. I am writing this treatise to indicate how to rescue them from litigation.

Advance Ruling

The present system of Advance Ruling allows residents to apply only in limited circumstances. The categories of residents permitted are public sector company and Public Limited Company only.

In the Budget 2013-14 Section 28E(a) of Customs Act and 23A(a) of Central Excise Act have been amended to provide for the individuals who are already importers/exporters to apply when they propose to undertake a new business and similarly, for manufacturers in excise, when they propose to start a new business of manufacture. If a taxpayer has already imported or started manufacture he cannot apply.

This is where the catch lies. The importer who has already imported or a manufacturer who has already started manufacturing should be allowed to apply, if there is already no litigation on the issue.

The definition of the expression 'advance' as in Section 28E of Customs Act can be amended to include where import has taken place but litigation has not started. The word advance will have an artificial meaning, but artificial meaning is quite legal Saifuddin vs. ACST-2008(227)ELT497(SC). So far only a few Rulings are issued by the Ruling Authority from the year 2001 to 31.5.2013:

(i) Customs-71 (ii) Central Excise-5 (iii) Service Tax-9.

This shows that the Advance Ruling Authority is thoroughly under-utilised because the individual taxpayers are disentitled to approach it. So my main point is that disentitlement must end.

At present, even if a litigation has started, the Board gives a ruling not mentioning the name of the litigant, but for the issue in general.

The only problem is that the Board gives very few rulings on classification, but many on procedural matters.

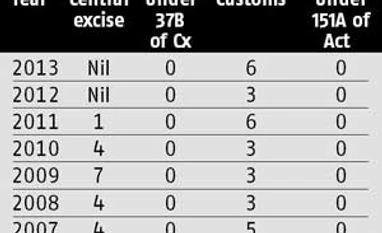

The number of rulings on classification given in the last few years is given in the table.

I have personally checked all circulars and have taken only those issued on classification. Section 37B and 151A have become dead letters.

Data above prove that the Board has practically abdicated its responsibility to give rulings on classification.

This is where my suggestion begins. A suitable legal provision should be made to compel the Board to issue circulars under 37B or 151A or otherwise to give clarification on classification when a tax payer applies. The clarification should not mention his name (as in the practice now).

Conclusion: Even after importation or manufacture or providing service has started, but litigation has not begun, the Advance Ruling Authority should give a ruling. Once litigation starts, the Board should give a ruling under Sections 37B and 151A.

smukher2000@yahoo.com

If he wants to know the correct rate of duty, there is no system by which he can get an authentic ruling. He does not mind paying a higher rate of duty, if there is a final ruling on it.

He may be convinced that the rate of duty to be paid by him is lower (may be on the basis of an expert opinion) but he cannot get an advance ruling which is firm in the sense that the department cannot go against it.

He can neither get an Advance Ruling nor a Board's Ruling. So if he pays a lower rate of duty, he may get into a dispute, which is practically never ending.

I am not writing here about the dispute resolution system, which is in any case cumbrous and heavily loaded against the taxpayer. Data show that 85 per cent or more cases are lost by the Department Gautam Ray in Indian Tax Administration by P Shome at p.178, which means almost all pleas by the taxpayer are simply rejected.

Moreover, the Law of Unjust Enrichment comes handy to the Department to deny refund. The existing provision only makes taxpayers to run from pillar to post. I am writing this treatise to indicate how to rescue them from litigation.

Advance Ruling

The present system of Advance Ruling allows residents to apply only in limited circumstances. The categories of residents permitted are public sector company and Public Limited Company only.

In the Budget 2013-14 Section 28E(a) of Customs Act and 23A(a) of Central Excise Act have been amended to provide for the individuals who are already importers/exporters to apply when they propose to undertake a new business and similarly, for manufacturers in excise, when they propose to start a new business of manufacture. If a taxpayer has already imported or started manufacture he cannot apply.

This is where the catch lies. The importer who has already imported or a manufacturer who has already started manufacturing should be allowed to apply, if there is already no litigation on the issue.

The definition of the expression 'advance' as in Section 28E of Customs Act can be amended to include where import has taken place but litigation has not started. The word advance will have an artificial meaning, but artificial meaning is quite legal Saifuddin vs. ACST-2008(227)ELT497(SC). So far only a few Rulings are issued by the Ruling Authority from the year 2001 to 31.5.2013:

(i) Customs-71 (ii) Central Excise-5 (iii) Service Tax-9.

This shows that the Advance Ruling Authority is thoroughly under-utilised because the individual taxpayers are disentitled to approach it. So my main point is that disentitlement must end.

At present, even if a litigation has started, the Board gives a ruling not mentioning the name of the litigant, but for the issue in general.

The only problem is that the Board gives very few rulings on classification, but many on procedural matters.

The number of rulings on classification given in the last few years is given in the table.

I have personally checked all circulars and have taken only those issued on classification. Section 37B and 151A have become dead letters.

Data above prove that the Board has practically abdicated its responsibility to give rulings on classification.

This is where my suggestion begins. A suitable legal provision should be made to compel the Board to issue circulars under 37B or 151A or otherwise to give clarification on classification when a tax payer applies. The clarification should not mention his name (as in the practice now).

Conclusion: Even after importation or manufacture or providing service has started, but litigation has not begun, the Advance Ruling Authority should give a ruling. Once litigation starts, the Board should give a ruling under Sections 37B and 151A.

smukher2000@yahoo.com

)