Some 37 years after he first became its director, Adi B Godrej resigned from the board of a little-known company called Vora Soaps on March 15. A day earlier, the 75-year-old doyen’s daughters Tanya Dubash and Nisaba Godrej, were inducted into Vora Soaps as additional directors. Their aunt and Adi’s cousin, Smitha V Crishna, also became a director of Vora Soaps around the same time.

Apart from Adi and Crishna, the third generation of the 120-year-old conglomerate, which has interests ranging from soaps and locks to real estate and agriculture, consists of Crishna’s brother Jamshyd N Godrej, who heads the unlisted Godrej & Boyce Manufacturing, Adi’s brother and chairman of Godrej Agrovet Nadir B Godrej and their cousin, Rishad Naoroji.

These five – Adi, Nadir, Jamshyd, Crishna and Rishad – and their family members together own the group through several trusts and investment firms. While the first three were active in business, Crishna and Rishad have been passive shareholders, though they have taken non-executive board positions in various group entities at different points of time.

Significance of Vora Soaps

Established in 1979, Vora Soaps’ corporate records describe it as a manufacturer and merchant of soaps, chemicals and cosmetics. As of March 2015, it had a paid-up capital of Rs 20 lakh and a balance sheet size of about Rs 12 crore.

What then is the significance of Vora Soaps and why is everyone moving in and out of it?

The answer lies in an exchange filing on March 22 by group flagship Godrej Industries. The company informed the exchanges that Godrej & Boyce had transferred its entire stake, 193.9 million shares or 57.69 per cent, to Vora Soaps. At Wednesday’s close of Rs 565 per share, these shares are worth close to Rs 11,000 crore.

The transaction, done without any consideration, makes Vora Soaps the primary promoter entity of listed Godrej Industries, which has significant stakes in several other group companies, including Godrej Consumer Products (23.76 per cent) and Godrej Properties (56.7 per cent). Thus, effectively, the person who controls Vora Soaps will have a significant say over Godrej Industries and Godrej Properties. An e-mail sent to spokespersons of the three group entities did not draw any response.

The other inter-se transfer

In Godrej Consumer Products, Vora Soap’s indirect stake amounts to a voting power of around 14 per cent.

This is where another company called Godrej Seeds and Genetics comes into the picture. On March 22, the same day it transferred its Godrej Industries stake to Vora Soaps, Godrej & Boyce also transferred, without consideration, its 93.5 million Godrej Consumer Products shares, amounting to a 27.45 per cent stake to Godrej Seeds and Genetics. At Wednesday’s close of Rs 1,924.8, this transfer is worth Rs 18,000 crore.

Corporate records show Nisaba, Dubash and Crishna are now directors of Godrej Seeds and Genetics also. Though Godrej & Boyce has fully exited from Godrej Industries, it still has about 25 million shares, or 7.34 per cent, in Godrej Consumer Products.

The two inter-se transfers change the ownership structure of the underlying listed entities and their subsidiaries.

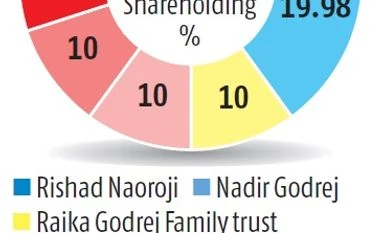

Rishad Naoroji was the top shareholder in Vora Soaps with a holding of 20.02 per cent, followed by Nadir Godrej at 19.98 per cent. Crishna’s children Nyrika and Freyan owned 10 per cent each. Navroze Jamshyd Godrej and the Raika Godrej Family Trust (controlled by Jamshyd’s family) owned 10 per cent each. Nisaba owned around 10 per cent while siblings Pirojsha (6.68 per cent) and Tanya (3.32) owned the rest.

Godrej Seeds and Genetics was set up in 2011 as a subsidiary of Godrej Agrovet, the group’s animal feed unit, which has equity investments from Singapore’s Temasek Holdings.

Godrej & Boyce’s holding structure & the road ahead

The five Godrej family groups and their holding firm, Godrej Investments, together owned 76.8 per cent in Godrej & Boyce, initially known for its locks. The remaining 23.2 per cent is held by the Pirojsha Godrej Foundation, a public charitable trust.

Today, Godrej & Boyce has 14 operating divisions and annual turnover of Rs 9,000 crore.

Godrej & Boyce received approvals for these two major share transfers, at current prices worth around Rs 29,000 crore, in an Extraordinary General Meeting on March 22.

An explanatory statement to the notice for this EGM outlines the road ahead for the group. “The primary benefit of the proposed restructuring of investment holdings is that it would greatly enhance the company’s flexibility for any future corporate action.

The company is not expected to monetise these assets, as the investments represent the promoter holding in these strategically important group companies.”

There was also a not so subtle hint of an initial public offering. “Given the current structure, actions such as an IPO, public listing of any individual business division, or a strategic partner coming on board, would be relatively difficult and expensive to implement,” the statement said, seeking shareholder support for the divestment.

While Jamshyd’s son, Navroze, is already on the board of Godrej & Boyce, Nadir was quoted saying on Tuesday that his eldest son, Burjis, would join Godrej Agrovet in July.

In February, Godrej Properties had elevated Adi’s son, Pirojsha, as its executive chairman. Though he is named chairman emeritus, Adi resigned from the real estate company’s board on April 1 after a 27-year stint.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)