It is widely believed that urban residential property in India is an excellent asset for large returns. But, is this borne out by data? Not really.

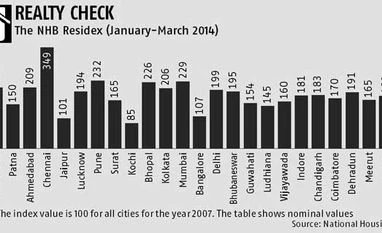

The NHB Residex (an index constructed by National Housing Bank based on "actual transaction prices") covers 26 cities all over India. The index stood at 100 in 2007 for each city. For January-March 2014, the all-India index was 178.69 (arrived at by taking a simple average of the index levels for the 26 cities). An increase from the base value of 100 in 2007 (on, say, 30-6-2007) to the recent value of 178.69 (on, say, 31-3-2014) translates to an average appreciation rate of 8.97 per cent annually.

This by itself is lower than the appreciation rates most people have in mind when they think of appreciation in the price of residential property in urban India. So, the public beliefs are not correct. However, there is even more to the story. There has been an average annual inflation rate of about 9.25 per cent since 2007-08 (this is based on the data used for computing real capital gains for income tax purposes). Inflation eats into whatever returns there are.

An 8.97 per cent nominal appreciation alongside a 9.25 per cent inflation rate implies the real appreciation rate over the period 2007-14 is a negative 0.28 per cent annually. Let us simplify and say the real appreciation has been zero. This is the basic story according to NHB data. This contradicts widely held beliefs in India.

A weighted average across 26 cities instead of a simple average can increase the computed appreciation rate but not enough to change the basic story.

There are considerable regional variations. Chennai has witnessed real appreciation of about 11 per cent annually, whereas Kochi has seen real depreciation at an average rate of about 11.5 per cent every year since 2007! Delhi and Mumbai have seen average real appreciation of 1.47 per cent and 3.8 per cent, respectively.

The NHB data is consistent with a recent International Monetary Fund report. It showed an international comparison of real appreciation in real estate in 52 countries for 2013, fourth quarter or latest (annual per cent change). There are 18 countries which had witnessed depreciation in real terms. And, guess what? India showed the maximum depreciation in real terms, at about eight per cent! (https://bsmedia.business-standard.comwww.imf.org/external/research/housing/index.htm).

The NHB data shows there has been hardly any real appreciation in urban residential property in India in the past seven years or so. We do not know anything about real appreciation in the earlier years from NHB data. Then, real appreciation might have been high. This can explain why people historically believe residential property is a good asset for investment purposes. This can also explain why absolute prices, as distinct from appreciation rates in prices, are high at present in parts of India.

Further, NHB data covers change in the price of residential property and not a change in price of land. It appears that appreciation in the latter case is more but, again, nothing definite can be said on the basis of published NHB data.

Finally, the average appreciation can be higher for new projects than in the case of property in older developments. It is the newer projects which are more in the news and so, there is a perception of more appreciation than there really is.

Financial savings of households dropped from 11.6 per cent of gross domestic product in 2007-08 to a poor eight per cent in 2011-12 (chart 1.11 in the Financial Stability Report of the Reserve Bank, June, 2013). This has been an important reason for the economic slowdown in India. One important reason for the large non-financial savings is a considerable investment in real estate. This is, in turn, due to expectations of high appreciation. Now, it turns out that this expectation is somewhat different from the reality in the past seven years. There is need for greater awareness, so that investors (and their financiers) are not disappointed later.

Low real appreciation is not good news for investors but it can be great news for new actual users, who are much more in numbers. Over time, housing can become more and more affordable if the recent trend continues. This can gradually obviate the need for the government to provide a stimulus for the sector in one form or another. There will also be less need for special schemes to provide affordable housing. Good, as such schemes come at a high cost to the public exchequer and usually involve red tape and corruption. The size of the market can anyway expand if prices are low. There can be a higher growth rate in real estate development, construction, employment and possibly even revenue for the government.

Real estate prices have a white money and black money component. It may be argued that official data pay attention to the former and this results in underestimation. This is right insofar as absolute prices are concerned but not quite valid where appreciation is concerned. Since it is the appreciation which is the focus here, the NHB data on changes in the index may be used.

NHB has done a pioneering job in bringing out Residex. Some may raise questions of methodology, and rightly so. While it can be very healthy to raise such questions, it can also be at the same time useful to somewhat update our beliefs on the basis of the data so far.

The NHB Residex (an index constructed by National Housing Bank based on "actual transaction prices") covers 26 cities all over India. The index stood at 100 in 2007 for each city. For January-March 2014, the all-India index was 178.69 (arrived at by taking a simple average of the index levels for the 26 cities). An increase from the base value of 100 in 2007 (on, say, 30-6-2007) to the recent value of 178.69 (on, say, 31-3-2014) translates to an average appreciation rate of 8.97 per cent annually.

This by itself is lower than the appreciation rates most people have in mind when they think of appreciation in the price of residential property in urban India. So, the public beliefs are not correct. However, there is even more to the story. There has been an average annual inflation rate of about 9.25 per cent since 2007-08 (this is based on the data used for computing real capital gains for income tax purposes). Inflation eats into whatever returns there are.

An 8.97 per cent nominal appreciation alongside a 9.25 per cent inflation rate implies the real appreciation rate over the period 2007-14 is a negative 0.28 per cent annually. Let us simplify and say the real appreciation has been zero. This is the basic story according to NHB data. This contradicts widely held beliefs in India.

A weighted average across 26 cities instead of a simple average can increase the computed appreciation rate but not enough to change the basic story.

There are considerable regional variations. Chennai has witnessed real appreciation of about 11 per cent annually, whereas Kochi has seen real depreciation at an average rate of about 11.5 per cent every year since 2007! Delhi and Mumbai have seen average real appreciation of 1.47 per cent and 3.8 per cent, respectively.

The NHB data is consistent with a recent International Monetary Fund report. It showed an international comparison of real appreciation in real estate in 52 countries for 2013, fourth quarter or latest (annual per cent change). There are 18 countries which had witnessed depreciation in real terms. And, guess what? India showed the maximum depreciation in real terms, at about eight per cent! (https://bsmedia.business-standard.comwww.imf.org/external/research/housing/index.htm).

The NHB data shows there has been hardly any real appreciation in urban residential property in India in the past seven years or so. We do not know anything about real appreciation in the earlier years from NHB data. Then, real appreciation might have been high. This can explain why people historically believe residential property is a good asset for investment purposes. This can also explain why absolute prices, as distinct from appreciation rates in prices, are high at present in parts of India.

Further, NHB data covers change in the price of residential property and not a change in price of land. It appears that appreciation in the latter case is more but, again, nothing definite can be said on the basis of published NHB data.

Finally, the average appreciation can be higher for new projects than in the case of property in older developments. It is the newer projects which are more in the news and so, there is a perception of more appreciation than there really is.

Financial savings of households dropped from 11.6 per cent of gross domestic product in 2007-08 to a poor eight per cent in 2011-12 (chart 1.11 in the Financial Stability Report of the Reserve Bank, June, 2013). This has been an important reason for the economic slowdown in India. One important reason for the large non-financial savings is a considerable investment in real estate. This is, in turn, due to expectations of high appreciation. Now, it turns out that this expectation is somewhat different from the reality in the past seven years. There is need for greater awareness, so that investors (and their financiers) are not disappointed later.

Low real appreciation is not good news for investors but it can be great news for new actual users, who are much more in numbers. Over time, housing can become more and more affordable if the recent trend continues. This can gradually obviate the need for the government to provide a stimulus for the sector in one form or another. There will also be less need for special schemes to provide affordable housing. Good, as such schemes come at a high cost to the public exchequer and usually involve red tape and corruption. The size of the market can anyway expand if prices are low. There can be a higher growth rate in real estate development, construction, employment and possibly even revenue for the government.

Real estate prices have a white money and black money component. It may be argued that official data pay attention to the former and this results in underestimation. This is right insofar as absolute prices are concerned but not quite valid where appreciation is concerned. Since it is the appreciation which is the focus here, the NHB data on changes in the index may be used.

NHB has done a pioneering job in bringing out Residex. Some may raise questions of methodology, and rightly so. While it can be very healthy to raise such questions, it can also be at the same time useful to somewhat update our beliefs on the basis of the data so far.

(The writer is an independent economist. He teaches an advanced course in financial economics at Indian Statistical Institute, Delhi (January-April). His work can be accessed at https://sites.google.com/site/gurbachansingh61/)

)