There is once again speculation that the government might introduce inheritance tax or estate duty. Many high net worth individuals (HNIs) have already set up trusts, or plan to do so, to ring fence their assets. They should weigh the pros and cons of this step before rushing in.

Beating the taxman: Currently, there is no tax in India when assets are bequeathed to heirs. Developed countries such as the United States and the United Kingdom levy this tax in cases where the asset size exceeds a certain limit. HNIs fear the Indian government may do the same.

Experts are of the view that a trust, if structured properly, can be an effective vehicle for delineating ownership of assets, which triggers inheritance tax, from the economic benefits arising from them. By using trusts, one can defer the transfer of assets, while still being able to direct the flow of income generated from those to the trust’s beneficiaries. “If an inheritance tax is introduced, family trusts would be out of its purview since no ownership is transferred. Only the shareholding of the trust changes,” says Nishit Dhruva, managing partner, MDP & Partners.

A trust provides several other benefits as well. “It can facilitate consolidation and smooth succession of assets. A will requires a probate and other legal formalities to ensure smooth transmission of assets. With a trust, one can do away with the administrative and legal issues and ensure a hassle-free transfer of assets,” says Gautami Gavankar, executive director, Kotak Mahindra Trusteeship Services. A trust structure can also be planned to ring fence assets against future liabilities. For instance, by placing assets in an irrevocable trust, a person can ensure that they are not attached by creditors. Also, by setting up a trust, families can ensure the functioning of the business doesn’t get disrupted due to disputes.

Loss of control: To escape inheritance tax, however, a person would have to set up an irrevocable trust. The person setting up the trust detaches himself from both control and beneficial interest. An irrevocable trust is a separate entity where the other family members can be beneficiaries, but not the person setting up the trust. “Only assets in an irrevocable trust cannot be attached by creditors in case of bankruptcy. And they may not be subject to inheritance tax also,” says Rajesh Narain Gupta, managing partner, SNG & Partners.

Setting up such a trust results in loss of control. “A person needs to contribute assets to the trust to form its corpus. This means that the transferor alienates legal ownership of the assets today. This can create a number of issues,” says Rajesh Thakkar, partner, tax and regulatory services, BDO India. Many people are wary of putting their assets in a structure whose benefits they can’t enjoy and where they lose control.

No clarity on inheritance tax: The inheritance tax law is not out yet. Nobody knows what form it will take. “The government may come up with an inheritance tax law that doesn’t exempt even those assets that have been transferred into a trust. In that case, what will people who are rushing to set up trusts do?” says Gupta. He adds that while people may create an irrevocable trust, they should not blindly transfer their assets to it. “Wait for the law to come, understand it, and then opt for the right structure,” he says.

People who need a trust for smooth succession planning and to ensure continuity of business may go ahead and create one. But those who wish to create a trust for the sole purpose of avoiding inheritance tax should wait and watch.

Transferring assets to a trust costs a lot of money. “Transfer of assets, especially real estate, is expensive. Suppose that you were to transfer your house to an irrevocable trust. You would have to pay stamp duty of around 6-8 per cent. On a house that costs Rs 100 crore, you may spend Rs 6-8 crore on stamp duty. And later you may find that the structure is not good for avoiding inheritance tax. In that case, your expense would go waste,” says Gupta.

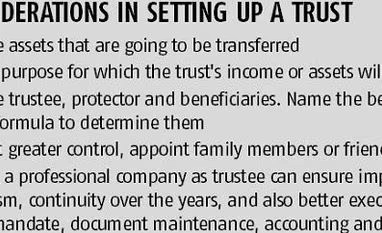

Setting up a trust: An important element in setting up a trust is formulating its trust deed. It is the key document that defines almost every aspect of a trust, starting from its creation, purpose, deployment of assets and even its liquidation. “A well drafted trust deed can be an effective tool to match the requirements of the contributor with the end use of the trust assets,” says Thakkar.

Finally, professionals say that the cost of setting up a trust can begin from Rs 1 lakh and go all the way up to Rs 25-30 lakh. The cost depends on the size of the assets in the trust, and also the time spent by the professionals on setting it up. The average cost is Rs 3-5 lakh. Thereafter, there is also an ongoing cost in the form of trustees’ fee.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)