Bangalore-based Dirk Lewis, 30, who works for a leading information technology services company, plans to subscribe to the National Pension System (NPS) from the next financial year (2014-15). His company offers the NPS option to its employees, over and above the mandatory Employees' Provident Fund (EPF) provision.

"NPS would help me save more on the tax front. Also, knowing myself, I would save only when I am forced to. This way (through NPS), I would be able to build a neat corpus for my retired life. I have some expenses this year, which wouldn't allow me to contribute towards NPS," says Lewis.

A host of companies, including Infosys, Wipro, Reliance Industries, Muthoot Finance, Colgate-Palmolive, Capgemini and Pantaloons, offer the NPS option.

Samir Gadgil, general manager and global head (compensation and benefits), Wipro, says the company has been seeing good traction from employees interested in NPS, over and above EPF. "On an average, annual contribution stood at Rs 4-6 crore. And, the number of employees subscribing to the scheme is growing on an annual basis," he says.

Wipro recommends NPS for product diversification, as well as a substitute for voluntary contribution towards EPF, Gadgil says.

Some companies say primarily, those in the 30-35 age bracket are subscribing to NPS, as they are aware the product's equity component could deliver good returns through 30 years.

George Alexander Muthoot, managing director of Muthoot Finance, feels NPS would help his employees build a decent retirement fund.

A company can either offer investment options at the subscriber level, allowing employees to choose the pension fund manager and the asset allocation (active choice), or at the company level, in which case the company decides the fund manager and the asset allocation (auto choice). Under the latter, the company may opt for the portfolio mandated for central government employees and choose from the three government fund managers - LIC Pension Fund, SBI Pension Fund and UTI Retirement Solution - or from schemes and fund managers for the voluntary sector.

All one has to do is subscribe to NPS and ask his/her employer to deduct a fixed amount every month or year. Many companies also contribute towards their employees' NPS and get tax benefits under Section 80CCE by terming this business expenditure in their profit-and-loss accounts. Even the employer's contribution of up to 10 per cent of basic and dearness allowance is eligible for deduction, though such employers later deduct their contribution from the employee's salary. Most companies ask for an annual contribution of at least Rs 6,000 (once a year), or at least Rs 500 a month. Many companies have spread awareness on NPS among employees through web seminars, group discussions and helpdesks at their campuses.

For Mumbai-based certified financial planner Gaurav Mashruwala, in their current forms, EPF scores over NPS, a view shared by Sumeet Vaid of Freedom Financial Planners.

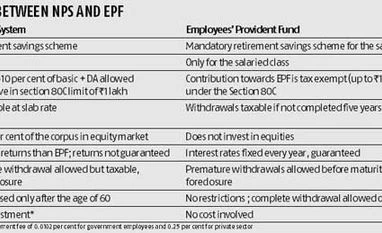

"Simply put, EPF is slightly market-driven to the extent of investing in government securities, while NPS is about 50 per cent market-driven, due to the equity component. As a result, returns are safe in EPF, not in NPS. There is a small cost attached to investing in NPS, but there is no cost in investing in EPF," says Mashruwala.

Also, NPS has withdrawal limits; EPF does not---it offers premature withdrawal for specific purposes (house construction, marriage and illness), without foreclosure. Any premature withdrawal leads to account closure in the case of NPS. Up to 20 per cent of the funds can be withdrawn from NPS before one turns 60; the rest has to be used to buy annuity. Also, you can easily stop contributing towards EPF in desperate times; you can't do so with NPS.

"One NPS fund manager I met recently told me they don't make money on NPS asset management; they hardly rejig the portfolio on the back of market conditions," says an industry expert. If fund managers aren't paid adequately, returns may soon start declining. The expert, therefore, feels the government should look at developing the product to make it more investor-friendly.

Also, NPS returns aren't very attractive. The Employees' Provident Fund Organisation (EPFO) gives 8.5 per cent returns to subscribers. Till August 2012, returns offered by NPS stood at 6-11 per cent (an average of 8.5 per cent). Though NPS should give better returns (compared to EPF) due to the equity component, this hasn't been the case. Therefore, it hasn't appealed to investors or financial advisors. Vaid says many company trusts that manage EPF money on their own have delivered higher returns - 9-9.5 per cent. Therefore, it might not be sensible to consider NPS.

Like Lewis, most look at NPS from a tax-saving perspective. Even then, the product doesn't seem lucrative. An employee's contribution of only up to 10 per cent of the basic and dearness allowance is eligible for deduction under Section 80CCD (this amount is within the Rs 1-lakh limit, under Section 80C). Most taxpayers exhaust a substantial part of the Section 80C limit through EPF contribution, which can be invested up to Rs 1 lakh, completely tax-free. Hence, contributing to NPS is hardly of any use, as long as you are an indisciplined investor and need to be forced into investing. A withdrawal from NPS is taxable at the slab rate and so is the annuity to be earned after retirement.

Therefore, Mashruwala advises sticking to EPF or Public Provident Fund (PPF), which offer annual returns of 8.7 per cent, and taking the equity-oriented balanced fund route to add equity to the retirement portfolio. According to mutual fund rating agency Value Research, equity-oriented balanced funds returned about seven per cent in the past year.

Financial experts feel for self-employed individuals, too, PPF scores over NPS, as investments of up to Rs 1 lakh in PPF are completely tax-exempt.

While Gadgil says an employee can continue using his NPS account even after quitting an organisation, Vaid is doubtful about whether an employee would be disciplined enough to continue investing on his own, as the organisation he joins next may not offer NPS. He says, "Servicing is better when a product is offered by an organisation. This might not be true for independent NPS accountholders. NPS' product structure might not be easy to understand for most." He recommends a combination of EPF/PPF, debt funds and index funds. In the past year, the BSE Sensex returned about nine per cent, while the National Stock Exchange's Nifty gave eight per cent returns. From a tax point of view, too, equity is very efficient---if held for more than a year, returns from equity investment are tax-free in the hands of investors. Across categories, debt funds have returned 9-11 per cent higher than NPS. Also, if held for more than a year, debt funds get indexation benefits.

"NPS would help me save more on the tax front. Also, knowing myself, I would save only when I am forced to. This way (through NPS), I would be able to build a neat corpus for my retired life. I have some expenses this year, which wouldn't allow me to contribute towards NPS," says Lewis.

A host of companies, including Infosys, Wipro, Reliance Industries, Muthoot Finance, Colgate-Palmolive, Capgemini and Pantaloons, offer the NPS option.

Samir Gadgil, general manager and global head (compensation and benefits), Wipro, says the company has been seeing good traction from employees interested in NPS, over and above EPF. "On an average, annual contribution stood at Rs 4-6 crore. And, the number of employees subscribing to the scheme is growing on an annual basis," he says.

Wipro recommends NPS for product diversification, as well as a substitute for voluntary contribution towards EPF, Gadgil says.

Some companies say primarily, those in the 30-35 age bracket are subscribing to NPS, as they are aware the product's equity component could deliver good returns through 30 years.

George Alexander Muthoot, managing director of Muthoot Finance, feels NPS would help his employees build a decent retirement fund.

A company can either offer investment options at the subscriber level, allowing employees to choose the pension fund manager and the asset allocation (active choice), or at the company level, in which case the company decides the fund manager and the asset allocation (auto choice). Under the latter, the company may opt for the portfolio mandated for central government employees and choose from the three government fund managers - LIC Pension Fund, SBI Pension Fund and UTI Retirement Solution - or from schemes and fund managers for the voluntary sector.

All one has to do is subscribe to NPS and ask his/her employer to deduct a fixed amount every month or year. Many companies also contribute towards their employees' NPS and get tax benefits under Section 80CCE by terming this business expenditure in their profit-and-loss accounts. Even the employer's contribution of up to 10 per cent of basic and dearness allowance is eligible for deduction, though such employers later deduct their contribution from the employee's salary. Most companies ask for an annual contribution of at least Rs 6,000 (once a year), or at least Rs 500 a month. Many companies have spread awareness on NPS among employees through web seminars, group discussions and helpdesks at their campuses.

For Mumbai-based certified financial planner Gaurav Mashruwala, in their current forms, EPF scores over NPS, a view shared by Sumeet Vaid of Freedom Financial Planners.

"Simply put, EPF is slightly market-driven to the extent of investing in government securities, while NPS is about 50 per cent market-driven, due to the equity component. As a result, returns are safe in EPF, not in NPS. There is a small cost attached to investing in NPS, but there is no cost in investing in EPF," says Mashruwala.

Also, NPS has withdrawal limits; EPF does not---it offers premature withdrawal for specific purposes (house construction, marriage and illness), without foreclosure. Any premature withdrawal leads to account closure in the case of NPS. Up to 20 per cent of the funds can be withdrawn from NPS before one turns 60; the rest has to be used to buy annuity. Also, you can easily stop contributing towards EPF in desperate times; you can't do so with NPS.

"One NPS fund manager I met recently told me they don't make money on NPS asset management; they hardly rejig the portfolio on the back of market conditions," says an industry expert. If fund managers aren't paid adequately, returns may soon start declining. The expert, therefore, feels the government should look at developing the product to make it more investor-friendly.

Also, NPS returns aren't very attractive. The Employees' Provident Fund Organisation (EPFO) gives 8.5 per cent returns to subscribers. Till August 2012, returns offered by NPS stood at 6-11 per cent (an average of 8.5 per cent). Though NPS should give better returns (compared to EPF) due to the equity component, this hasn't been the case. Therefore, it hasn't appealed to investors or financial advisors. Vaid says many company trusts that manage EPF money on their own have delivered higher returns - 9-9.5 per cent. Therefore, it might not be sensible to consider NPS.

Like Lewis, most look at NPS from a tax-saving perspective. Even then, the product doesn't seem lucrative. An employee's contribution of only up to 10 per cent of the basic and dearness allowance is eligible for deduction under Section 80CCD (this amount is within the Rs 1-lakh limit, under Section 80C). Most taxpayers exhaust a substantial part of the Section 80C limit through EPF contribution, which can be invested up to Rs 1 lakh, completely tax-free. Hence, contributing to NPS is hardly of any use, as long as you are an indisciplined investor and need to be forced into investing. A withdrawal from NPS is taxable at the slab rate and so is the annuity to be earned after retirement.

Therefore, Mashruwala advises sticking to EPF or Public Provident Fund (PPF), which offer annual returns of 8.7 per cent, and taking the equity-oriented balanced fund route to add equity to the retirement portfolio. According to mutual fund rating agency Value Research, equity-oriented balanced funds returned about seven per cent in the past year.

Financial experts feel for self-employed individuals, too, PPF scores over NPS, as investments of up to Rs 1 lakh in PPF are completely tax-exempt.

While Gadgil says an employee can continue using his NPS account even after quitting an organisation, Vaid is doubtful about whether an employee would be disciplined enough to continue investing on his own, as the organisation he joins next may not offer NPS. He says, "Servicing is better when a product is offered by an organisation. This might not be true for independent NPS accountholders. NPS' product structure might not be easy to understand for most." He recommends a combination of EPF/PPF, debt funds and index funds. In the past year, the BSE Sensex returned about nine per cent, while the National Stock Exchange's Nifty gave eight per cent returns. From a tax point of view, too, equity is very efficient---if held for more than a year, returns from equity investment are tax-free in the hands of investors. Across categories, debt funds have returned 9-11 per cent higher than NPS. Also, if held for more than a year, debt funds get indexation benefits.

)