Five years have gone by since the Lehman crisis. The valuations were at rock-bottom levels five years ago. The BSE Sensex's price-earnings ratio stood at 12.56 in March 2009 as compared to the current 17.81 times trailing 12-month earnings. It was time when fund managers could blindly pick winners, since these were available at throwaway prices. Yet, a study of the performance of mutual funds over the five years shows that only a handful outperformed the BSE Sensex. Also, there's a significant divergence between the top and bottom-rung funds.

Average returns of the worst-performing open-ended diversified equity funds (across capitalisations) have been merely 11.3 per cent annualised, while the BSE Sensex returned 19.3 per cent. The difference between the Sensex and the also-ran funds is a gaping 800 basis points, suggesting that stock picking wasn't easy for those funds. It should have been, though.

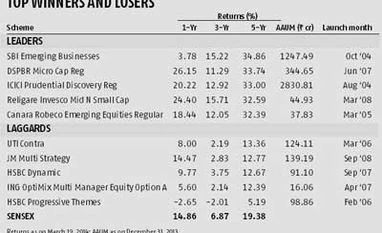

The top five performers generated returns of 32.9 per cent, against the Sensex's 19.4 per cent, another vast outclassing of 1,350 basis points. In a study by Business Standard on equity fund performance since the Lehman crisis, all the top-performing funds were mid-cap and small-cap ones.

Says Vetri Subramaniam, chief investment officer, Religare Invesco MF: "The starting point in the last five years was at crisis levels. Mid-caps were available at a significant discount to large-caps. Which is why many more of these funds were available that could lead to significant outperformance over frontline indices."

In fact, the presence of a large number of mid-cap and small-cap funds among the top performers highlights that their potential to out-perform was far superior to that of the large-cap MFs. In fact, the top 15 funds that outshone were among the mid-caps.

Funds that didn't have many of the top 100 stocks did better. Says R Srinivasan, head of equity, SBI MF: "The large-cap index is fairly representative; the mid-cap index is not well representative of the mid-cap space. There are enough small and mid-cap stocks out there. A careful stock selection has helped a lot of mid-cap funds."

But the striking feature of these five years is that the BSE mid-cap index wasn't among the star performing ones. The index returned 19.5 per cent, equal to the performance of the large-caps. Experts note there was no mid-cap rally that lifted all boats. Rather, it was a steady market, which offered significant opportunity to create out-performance. Five years earlier, mid-caps were available at 30-40 per cent discounts to large-caps.

Experts also say it wasn't a cakewalk for fund managers. There were a few mid-cap funds unable to get their stock selection right; this saw these undershooting the bellwether index. Says Subramaniam: "Funds that were able to get their stock selection right did significantly better. If you don't get it right in the mid-cap space, you can be punished very dramatically."

He attributes the success of his mid-cap fund to careful selection of undervalued businesses which can be scaled up significantly, and a bottom-up approach.

Winning approach

A considered approach to portfolio construction ultimately distinguishes winners from losers. Evaluating a fund on a short-term basis might upset you in the equally short run. In the past one year, a little over 60 per cent of equity schemes undershot the broadly-tracked BSE Sensex.

In equity, the past few years have marked significant shifts in businesses and market cycles. While the first phase saw an immediate rebound in financials, the second saw a run-up in defensives, with the financials crashing. Now, industrials and capital goods businesses are doing well. Those funds which actively "managed" their portfolios to growth stories and identified business models early on captured value for investors.

Those that could time the bottom of the cycle early, such as in reducing exposure to financial services in favour of export-oriented sectors, came out trumps. Their schemes turned out to be champions of the year. Some fund managers were confident of a reversal in the interest-rate cycle but rising inflation washed away their expectations and resulted in their schemes underperforming.

Among those that did well was SBI Emerging Business Fund, which started as one for high-conviction stock ideas, with a highly-concentrated portfolio. It turned out, though, that many of the stock "ideas" in this fund were available in the mid-cap arena.

Among the other top performers was ICICI Prudential Discovery Fund, which sticks to an approach of finding deep value, combined with growth. The investment basket entails mostly small-cap and mid-cap companies.

Of the others, the Religare Mid and Small-cap Fund has an approach of looking for stocks with good and low valuation but scalable business models. This allows the fund not only to benefit from normal business growth but from any significant valuation re-rating that would boost a stock's price performance.

The future

Even now, investors can expect that mid-cap and small-cap funds continue outshining, as they yet command a significant valuation discount than the large-caps. Says Subramaniam: "The opportunity is visible in mid-caps and cyclical businesses and there's also a valuation advantage. However, it's not as much as around five years before but something like 12-14 per cent."

Experts also say many of these funds are now concentrating on picking good value stocks with a high growth and such an opportunity is now available in the mid-cap space. Says Srinivasan: "There's a research arbitrage and that gives us an opportunity because that space is less explored. There is always a greater opportunity when the range of stocks that one can choose from is very high."

Average returns of the worst-performing open-ended diversified equity funds (across capitalisations) have been merely 11.3 per cent annualised, while the BSE Sensex returned 19.3 per cent. The difference between the Sensex and the also-ran funds is a gaping 800 basis points, suggesting that stock picking wasn't easy for those funds. It should have been, though.

The top five performers generated returns of 32.9 per cent, against the Sensex's 19.4 per cent, another vast outclassing of 1,350 basis points. In a study by Business Standard on equity fund performance since the Lehman crisis, all the top-performing funds were mid-cap and small-cap ones.

Says Vetri Subramaniam, chief investment officer, Religare Invesco MF: "The starting point in the last five years was at crisis levels. Mid-caps were available at a significant discount to large-caps. Which is why many more of these funds were available that could lead to significant outperformance over frontline indices."

In fact, the presence of a large number of mid-cap and small-cap funds among the top performers highlights that their potential to out-perform was far superior to that of the large-cap MFs. In fact, the top 15 funds that outshone were among the mid-caps.

Funds that didn't have many of the top 100 stocks did better. Says R Srinivasan, head of equity, SBI MF: "The large-cap index is fairly representative; the mid-cap index is not well representative of the mid-cap space. There are enough small and mid-cap stocks out there. A careful stock selection has helped a lot of mid-cap funds."

| BEHIND THE NUMBERS |

|

But the striking feature of these five years is that the BSE mid-cap index wasn't among the star performing ones. The index returned 19.5 per cent, equal to the performance of the large-caps. Experts note there was no mid-cap rally that lifted all boats. Rather, it was a steady market, which offered significant opportunity to create out-performance. Five years earlier, mid-caps were available at 30-40 per cent discounts to large-caps.

Experts also say it wasn't a cakewalk for fund managers. There were a few mid-cap funds unable to get their stock selection right; this saw these undershooting the bellwether index. Says Subramaniam: "Funds that were able to get their stock selection right did significantly better. If you don't get it right in the mid-cap space, you can be punished very dramatically."

He attributes the success of his mid-cap fund to careful selection of undervalued businesses which can be scaled up significantly, and a bottom-up approach.

Winning approach

A considered approach to portfolio construction ultimately distinguishes winners from losers. Evaluating a fund on a short-term basis might upset you in the equally short run. In the past one year, a little over 60 per cent of equity schemes undershot the broadly-tracked BSE Sensex.

In equity, the past few years have marked significant shifts in businesses and market cycles. While the first phase saw an immediate rebound in financials, the second saw a run-up in defensives, with the financials crashing. Now, industrials and capital goods businesses are doing well. Those funds which actively "managed" their portfolios to growth stories and identified business models early on captured value for investors.

Those that could time the bottom of the cycle early, such as in reducing exposure to financial services in favour of export-oriented sectors, came out trumps. Their schemes turned out to be champions of the year. Some fund managers were confident of a reversal in the interest-rate cycle but rising inflation washed away their expectations and resulted in their schemes underperforming.

Among those that did well was SBI Emerging Business Fund, which started as one for high-conviction stock ideas, with a highly-concentrated portfolio. It turned out, though, that many of the stock "ideas" in this fund were available in the mid-cap arena.

Among the other top performers was ICICI Prudential Discovery Fund, which sticks to an approach of finding deep value, combined with growth. The investment basket entails mostly small-cap and mid-cap companies.

Of the others, the Religare Mid and Small-cap Fund has an approach of looking for stocks with good and low valuation but scalable business models. This allows the fund not only to benefit from normal business growth but from any significant valuation re-rating that would boost a stock's price performance.

The future

Even now, investors can expect that mid-cap and small-cap funds continue outshining, as they yet command a significant valuation discount than the large-caps. Says Subramaniam: "The opportunity is visible in mid-caps and cyclical businesses and there's also a valuation advantage. However, it's not as much as around five years before but something like 12-14 per cent."

Experts also say many of these funds are now concentrating on picking good value stocks with a high growth and such an opportunity is now available in the mid-cap space. Says Srinivasan: "There's a research arbitrage and that gives us an opportunity because that space is less explored. There is always a greater opportunity when the range of stocks that one can choose from is very high."

)