With interest rates on bank deposits (both fixed and savings) and small savings instruments headed downward, fixed-income investors are on the lookout for a product that can give them an attractive rate of return without having to court risk. One instrument is Voluntary Provident Fund (VPF).

If you are a salaried employee, 12 per cent of your basic salary plus dearness allowance would already be going into the Employees' Provident Fund (EPF) each month. Your employer would be making a matching contribution. In addition, you can also invest up to 100 per cent of your basic salary plus dearness allowance in VPF.

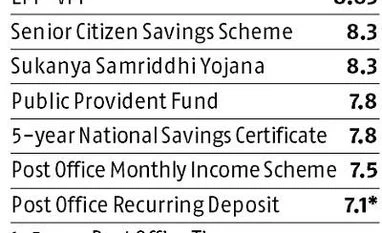

The returns you earn will be the same as in EPF. EPF gave a return of 8.65 per cent in 2016-17. This is better than the rate offered by Post Office small savings schemes (see table). The State Bank of India now offers 5.50-6.75 per cent on its fixed deposits. The best rates offered by any bank go up to 7.50 per cent (about 50 basis points higher for senior citizens) for a tenure of up to five years.

The rate offered on EPF/VPF for 2017-18 will be known only in November-December or later. While it could decline from the current level if interest rates within the economy continue to fall, the returns from EPF/VPF are likely to be the most attractive on the fixed-income side.

Bear in mind, though, that your employer doesn't make a matching contribution to VPF.

Besides the return, another attractive aspect of VPF is that, like EPF, it enjoys EEE (exempt-exempt-exempt) status. Many small savings instruments (such as National Savings Certificate and Kisan Vikas Patra) and bank fixed deposits get taxed at maturity at the individual's marginal tax rate. In addition, you also enjoy tax deduction under Section 80C up to Rs 1.5 lakh in VPF.

To enrol for VPF, get in touch with your office's human resource department and inform it in writing about the percentage of your basic salary plus dearness allowance you would like to contribute.

Financial planners are of the view VPF is an excellent product. “With its guaranteed and attractive tax-free return, it is a good product for the debt portion of your retirement portfolio,” says Deepesh Raghaw, founder, PersonalFinancePlan.in, a Sebi-registered investment advisor. Mumbai-based financial planner Arnav Pandya suggests that before opting for VPF, investors also consider the National Pension System (NPS). “Returns from even the debt funds of NPS have been attractive,” he says.

Over the past five years, tier-I government bond (G) funds have given annualised returns ranging from 10.55-10.98 per cent, while tier-I corporate bond (C) funds have given returns in the range of 10.99-11.45 per cent, according to the NPS Trust website. According to Rohit Shah, financial planner and chief executive officer, Getting You Rich, “Younger investors with the necessary risk appetite should opt for equity mutual funds in their retirement portfolio if they wish to generate an adequate retirement corpus.”

Before deciding to enrol for VPF, do a proper budgeting exercise to know your aggregate monthly requirement. “Your money gets locked in for the long term, so it shouldn’t happen that you run into liquidity problems and then have to take a personal loan,” says Pandya.

One risk experts foresee with EPF and VPF is that exposure to equities is gradually being hiked. “You can’t offer guaranteed return while having equities as the underlying investment. This could lead to problems at some point in the future,” says Raghaw.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)