In India, rising per capita income has led to the pursuit of an aspirational lifestyle. Consumers want to possess the very best of everything. With big financial goals and limited financial means, people often turn to bank credit to fulfil them. Increasing reliance on loans is evident from the Reserve Bank of India data of February 2018 which showed that retail loans have touched a new high at 25 per cent of overall loans. With loans becoming an integral part of the financial landscape, customers need to learn how to manage them effectively.

Do the groundwork

Taking a loan will have long-term implications on your finances, which you should try to understand before applying. Start by defining your loan requirements and your repayment capabilities based on your income. Even if you are eligible for a higher loan amount, stick to what you need. Use online portals to identify the interest rate applicable to your loan category. Use the highest rate of interest to understand the impact the loan will have on your finances. Using an online calculator, calculate the EMI you will be required to pay. If the figure you arrive at is on the higher side, try to adjust the loan amount or the duration to fit it within your means.

Next, learn as much as you can about the application process. Read up on the eligibility criteria and keep all the required documents ready for the process. Read the terms and conditions carefully and seek clarification if need be. Seek help from a trustworthy financial expert if you feel lost.

Research will help you to become more aware of the various options available and all the costs involved in the loan application process. You will learn that loan cost is not limited to interest and EMIs. There are a few ancillary charges as well that will have to be paid. Be wary of any fees linked to your loan amount as it can have a significant impact on your outflows.

Minimise interest payment

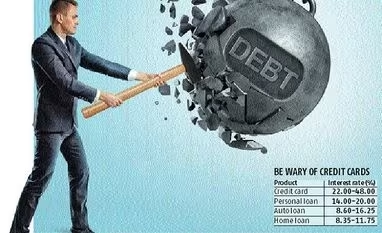

The rate of interest on a personal loan can range from 14-20 per cent. A few steps can ensure that you pay the least possible interest on your loan. The first is that you should shop around. Use online platforms to compare the rate of interest offered by different banks in your loan category. Select the one that works the best for you.

Next, negotiate with the bank. Competition in the banking sector has opened up possibilities for negotiating the terms and conditions for your loans, so try to get the best deal for yourself. Interest rates on loans against assets such as gold, shares and deposits tend to be lower than on personal loans. Explore those options.

If you have maintained a healthy credit score, that will come in handy now. Higher the credit score, lower will be the interest rate offered by the bank. Timely repayments of EMIs and loan foreclosures help in maintaining a high credit score.

Another trick to minimise interest outgo is to consolidate multiple loans into one that entails lower interest rate payment as compared to total payment against individual loans. Finally, keep a track of changes in interest rates. If you can get better rates, refinance your current loan, which may entail an additional charge.

Use additional income to repay loans

Use any increase in income or bonus you receive this appraisal season to repay your loans. While the temptation to treat yourself for all your hard work would be high, keep this urge in check to free yourself from the debt cycle. Apply either or both the strategies mentioned below to make the best use of your appraisal.

The first is to pay an additional EMI. If you have an outstanding home loan of, say, Rs 200,000 at 12 per cent for 12 years, your EMI would be Rs 2,627 and total interest payment would be Rs 178,265. By paying an additional EMI every year, once you receive your bonus, you can save Rs 14,855 on your loan payments.

The second option you have is to increase your EMI. Say, you receive a 5 per cent increment in your salary every year. You can reduce the tenure of your loan repayment by bumping up your EMIs by 5 per cent each year as well.

Prioritise loan repayment

If you find yourself in a situation where you have multiple loans, prioritise repayment of the loan that has the highest interest rate. By repaying EMIs on such loans, you will reduce your interest burden significantly, and this will help release your resources for other liabilities. While doing so, ensure that you continue to pay your other loans in a timely manner as any late payment will attract a penalty and escalate your outflows further.

Buy insurance for personal loan

In a world full of uncertainty, events like job loss, accident or death can make loan repayment a burden for your family. To hedge against such upheavals, you should insure your personal loans so that the onus of repayment does not fall on your family or dependants in case of non-payment. The premium for such insurance can be paid on a lump sum basis or clubbed with your regular loan installment. Various insurance companies have started offering such covers for personal, home and auto loans. Exercise due diligence and compare various policies to select the one that suits your unique financial situation. It would be wise to opt for such covers against high-interest loans as any non-payment on such loans could mean a higher financial burden.

Get the best deal on a loan

- Use online platforms to compare the interest rates offered by different banks

- Once you narrow down on lenders, talk to them to see what they have to offer

- Competition in the banking sector has opened up possibilities for negotiating the terms and conditions. Evaluate what works in your favour

- Those who have existing loans, keep track of interest rates changes. If you can get better rates, refinance your current loan

The writer is MD & CEO, Axis Securities

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)