A high level of inertia: Most business families don't begin succession planning in time for fear of opening a Pandora's Box. They feel that initiating the process will disturb the family's harmony. What they don't realise is that sweeping this issue under the carpet doesn't make it go away. The problem only grows bigger over time and has far worse consequences than if it is dealt with on time.

Procrastination is another common reason for not starting the process. Most heads of business families feel that the present is not the right time. Since they are busy people, they keep postponing this crucial task for another day.

Sometimes, patriarchs don't undertake succession planning for fear of losing ownership and control. Such fears are unfounded and arise from lack of knowledge about the trust structure and how it operates. A trust, in fact, allows a lot of flexibility and can be tailored to meet the exact needs and specifications of the patriarch.

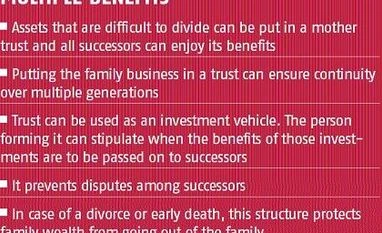

Not undertaking succession planning can lead to many negative consequences. The lack of clarity regarding what they will receive often creates a sense of insecurity among the successors. Often, fights erupt because family members are unaware of what their share will be when the assets are finally passed on to them.

To deal with all these issues, business families need to carry out succession planning through trusts.

We proposed a structure where all commonly held assets would be transferred to a mother trust. Benefits would be passed equally from the mother trust to the sons. We also created personal trusts to hold the personal assets of all the sons.

Many assets held by families are difficult to divide. For instance, many business families own expensive holiday homes in exotic destinations. All the children may want a piece of that asset. When dividing an asset becomes difficult, it can be parked in a mother trust and all family members can share the benefits arising from it. Personal trusts, on the other hand, can be used to hold assets that belong individually to each successor.

Multi-generational business model: Sometimes, shares of the family businesses are transferred into a trust and an intra trust shareholding agreement is created. Doing this is especially handy in case of larger families. In future, the number of beneficiaries will grow. An intra trust agreement takes care of potential issues by setting out rules for exiting the trust, the valuation methodology to be followed in that case, voting rights and dividend rights. Such a structure can help a family build a multi-generational business model.

Ring fencing assets: A trust can also be used as an asset protection tool to ring fence assets. In situations like divorces, a trust structure can be used to protect the interest of family members. Often nowadays when a member of a business family gets married, the family engages an estate planner to create a trust and thereby protect the interests of the family. The goal behind such an exercise is to prevent, in the worst-case scenario of a divorce, family assets from going out of the family. When a divorce happens, the spouse gets a part of the estate. Such ring-fencing through trusts is especially important in India where prenuptial agreements are not deemed valid.

In case a person dies early and the children are still minors, the surviving spouse becomes the guardian and gets control over the person's assets. In case the spouse gets married again, there is a chance that the assets could go outside the family. The children may possibly not even get those assets when they grow up.

To prevent such an eventuality, a person's assets can be put in a trust with the beneficiaries properly defined. The benefits to the spouse can be clearly spelt out. It could even be stipulated that if the spouse remarries, he/she will not be entitled to any benefits, or could be given only limited benefits from the trust.

Even investments can be planned via the trust route. A person can create an education fund, marriage fund, a fund for the child to start a new business, and so on. These investments can be held by the trust and allowed to grow until it is time to pay the money out to the beneficiary, according to the desires of the patriarch.

By creating a trust, families also have the option to choose the beneficiaries. The amount of benefits can be spelt out. A family can even choose to devolve its assets among successors disproportionately. The timeline for devolution can also be specified.

Mistakes to avoid: Those who want to set up trusts should be clear about their objective for setting up a trust. Is it for estate planning — to prevent disputes among successors? Is it to ensure business continuity over multiple generations? and so on. One should also avoid being short-sighted in the matter of setting up a trust. When taxation was imposed on dividend income above Rs 10 lakh, many individuals moved their shares into trusts. The move proved futile as next year the government brought trusts too within the ambit of taxation. There should ideally be a longer term vision behind setting up a trust.

It is also advisable not to make the trust structure too complex. Simpler structures prove to be more robust over the long term. The writer is MD and CEO, Terentia

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)