The BSE Sensitive index, or Sensex, has hit a purple patch. With the market breaching new highs, at over 35,000 points currently, stock market investors have seldom had it so good. But, when the going is so good, it is also the time to be more diligent. Most investment experts, therefore, are striking a cautious note.

Existing investors should take some profit off the table: This is the first advice of investment experts. “At these market levels, for investors who have made some profits (0-50 per cent), it is recommended that they hold on to portfolio positions and stay invested. Incremental money should be invested only through the systematic route every month. For investors, who have made significant profits (more than 50 per cent) it is recommended that they take some profits off the table and wait for a correction to take new portfolio positions,” says Akshay Gupta, group executive head and chief executive officer (CEO), Indiabulls Asset Management.

Arun Kejriwal, director, Kris Securities agrees. According to him, existing investors can take some profits off the table and sit on idle cash. “This could a good strategy at this point in time,” says he.

Opportunities will come: Most investment experts believe there could be a lot of volatility this year. And, there will be enough opportunities for investor seeking value. “There will be dips, and when that happens, enter the market incrementally,” Kejriwal adds. And, the suggestion is that one uses the rupee cost averaging method. That is, if you have booked profits of Rs 1 million, then on each correction, you could invest say, Rs 100,000 so that if there is more correction, you do not completely lose the profits booked earlier, in one shot. In fact, you could put in more in the next correction.

For the brave-hearted, Kejriwal suggests putting money in some of the upcoming initial public offerings (IPOs), as it could be a good way of making a quick buck. “Though good market conditions mean that IPOs will be expensive, there are also chances of making good money from this route for those who are sitting on good profits,” he says.

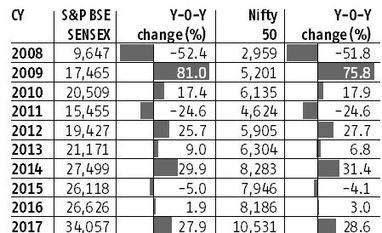

Mistakes to avoid: The biggest mistake that investors can make in this bull market is to forget diversification. First-time investors in equities should not get carried away by the spectacular returns of the equity markets in 2017. If you only chase last year’s outperforming asset class, it can mean disappointing returns next year. “If you only bought last year’s winners, you would have bought equities heavily at the start of 2010, gold at the start of 2013, and bonds at the start of 2016. After a stellar performance in the previous year, all these asset classes gave disappointing returns the next year,” says Kunal Bajaj, founder and chief executive officer, Clearfunds, a Sebi-registered online mutual fund advisor.

According to him, at the end of December 2017, the average assets under management (AUM) of mid-cap funds was Rs 29.38 billion. The average AUM of large-cap funds today is smaller at Rs 23.96 billion. The average mid-cap fund is today 23 per cent larger than the average large-cap fund. This was not always so. At the end of December 2013, the average size of mid-cap funds was Rs 5.09 billion, while that of the average large-cap fund was Rs 6.94 billion. In other words, the average mid-cap fund was about 36 per cent smaller than the average large-cap fund. “It tells you that a lot of money is chasing mid- and small-cap funds driven by last year's performance,” adds Bajaj.

New investors should not deploy large sums of money at the current high prices. Instead, they should invest it in a staggered fashion.

Jatin Khemani, founder and chief executive officer, Stalwart Advisors, an equity research firm says: “Investors should also not turn greedy and invest in momentum stocks — the ones that are moving up very fast and hitting the circuits every day, especially small-cap and micro-cap stocks. Don’t ignore the fundamentals of the stocks that you invest in and chase momentum. Understand the company that you are investing in, avoid paying a very high valuation for the stocks you purchase, have reasonable return expectations since markets have risen a lot, and finally, invest gradually and for the long term.”

According to experts, all investors entering now should take a long term view and preferably invest through the mutual fund route unless they have done thorough analysis of the company whose stock they are taking a position in. “Stock markets are expensive and caution is certainly warranted,” adds Gupta.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)