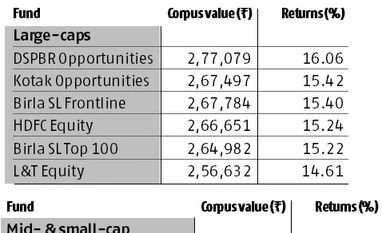

The recently published Sebi investor survey said nearly 60 per cent of investors buy mutual funds (MFs) through the systematic investment plan (SIP) route. It’s the best strategy, that averages your cost of purchase and lets you tide over the ups and downs in the stock market effectively. Almost Rs 5,000 crore comes into MFs through the SIP route each month. If you had been an early adopter of the SIP approach, see the tables for the returns you would have made.

- Many diversified equity funds have given annualised returns of 14 per cent and above, going all the way to 24 per cent, over the past decade for those who took the SIP route. These are very attractive returns

- The 10-year SIP returns improve as you go down the market cap ladder

- This does not, however, mean you should invest more in flexi-cap funds and mid- and small-cap funds than in large-cap funds

- These funds are more volatile and so the largest chunk of your portfolio should be in large-cap funds

- By having a long investment horizon of seven years or more, you can smoothen out the volatility in flexi- and mid- and small-cap funds, and benefit from their high return potential

)