Gratuity is one benefit enjoyed by salaried employees, the other being the Employees Provident Fund (EPF). All employers who have more than 10 employees have to mandatorily pay gratuity. As per the Payment of Gratuity Act, gratuity has to be paid after five years of service on separation or retirement with a limit of Rs 10 lakh. Some companies pay gratuity even if employees don’t complete five years of employment.

Broadly, there are two sets of employees. One has a gratuity limit of Rs 10 lakh, in strict accordance with the Payment of Gratuity Act, while the other has gratuity without any limits. “Many companies do not limit the gratuity to Rs 10 lakh and provide it without limit. Some companies also follow a hybrid plan, giving increased benefit with increasing years of service. Many, for instance, pay one month of salary for each year of service, instead of 15 days, after an employee completes, say, 15 years,” says Chitra Jayasimha, senior actuary and practice leader, retirement and investment, Aon Hewitt.

The first set of employees (those with the limit) will benefit from increased gratuity as and when they reach the current cap. The second set of employees (who are already on no limit) will benefit from tax exemption up to Rs 20 lakh, which is currently at Rs 10 lakh, she adds.

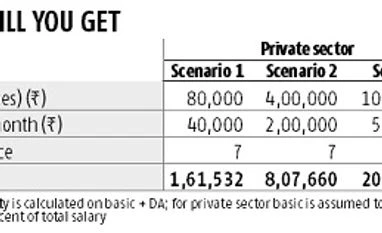

The gratuity amount depends on the tenure of service and the last drawn salary. The formula is as follows: Last drawn salary (basic salary plus dearness allowance) X 15/26 X number of completed years of service. For an employee with a basic salary of Rs 2 lakh and past service of 15 years, the gratuity benefit in the current scenario will get capped at Rs 10 lakh. In the new scenario, his gratuity benefit will be Rs 17.30 lakh.

“The current gratuity limit of Rs 10 lakh does cover a large chunk of employees considering the shorter tenure and the age of the workforce in the organised private sector. However, the effect may be significant for senior employees with higher salaries. Hence, the increase in the limit to Rs 20 lakh will largely impact senior level employees whose salaries are high. This would also have an impact on companies’ financials as it would increase their liability. Employers would now be required to make provision based on the enhanced gratuity limit ,’’ says Anil Lobo, India Business Leader-Retirement, Mercer.

If your gratuity payment exceeds the limit, currently Rs 10 lakh and proposed Rs 20 lakh, then any amount above that limit is taxed as per your income tax slab. For example, if the gratuity payout is Rs 25 lakh, the excess Rs 5 lakh (above the future limit of Rs 20 lakh) will be taxable.

According to Sudip Mukhopadhyay, principal consultant, Phronesis, a health insurance and employee benefits consulting firm, in the short term the change in the statutory level helps only senior management people in the private sector and mid to senior government officials. “The government should look at an inflation-adjusted increase every five years and focus on increasing retirement funding for the SME and unorganised sectors,’’ he says.

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)