He said the government is using more than three-fold increase in cess on petrol and diesel to fund infrastructure projects like highways, but it will be a challenge to fund higher social sector spending due to increased outgo on salary and pension.

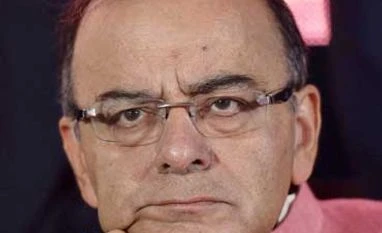

Speaking at the Hindustan Times Leadership Summit, he cited the example of the girl child scheme launched last year to saying that "if after one year you immediately slash it (interest rate) down radically, (it) may not be very politically prudent and therefore you have to move in that direction but you have to move a little cautiously".

Also Read

As a lot of people depend on small savings schemes, the Finance Minister said, "we as an elected government have to look at it in addition to the economic principles with a sense of political pragmatism".

Bankers have passed on as little as 20 per cent of the biggest rate cut effected by RBI since 2009 as they fear becoming uncompetitive to small savings like PPF and Post Office deposits.

Most small saving instruments pay an interest rate of 8.75 per cent, compared to 7.5 per cent on deposits at SBI.

Bank deposit rate has to be lowered if the lending rate is brought down to allow transmission of 1.25 per cent interest rate cut by RBI.

Jaitley said the impact of the 7th Pay Commission recommendations for higher salary and pension for central government employees, which will result in an additional annual burden of Rs 1.02 lakh crore on exchequer, would last for two to three years.

The recommendations are to be implemented from January 1.

"I am not particularly worried about the fiscal deficit target," he said.

The government, he said, was confident of keeping spending within the the targeted fiscal deficit of 3.9 per cent for the current fiscal year ending March 31, 2016. Besides meeting the target, the quality of fiscal deficit too will be improved, he added.

)