It’s not a bear market. Or is it? The Sensex touched an all-time high of 30,025 on 4th March 2015, from where it fell 17% to 24,833 by September. That’s almost bear territory if you consider a 20% correction as the peak as a bear market. Since then, it has staged a mild recovery to current levels of 26,170. At current levels, the Sensex has given a paltry 3.8% compounded annual growth rate (CAGR) since November 2007, when India was in the midst of a roaring bull market. Things are worse for the Foreign Institutional Investor (FII): Eight years ago, on 30th November 2007, the Nifty was at 5763 and the INR at Rs40/USD. Since then, while the Nifty has risen 38% to 7935, the INR has also depreciated by a whopping 68% to Rs66.8/USD – implying a net loss of 18% in the Nifty investment.

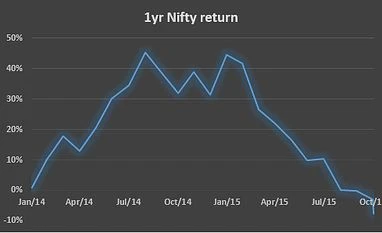

But point-to-point returns are misleading and show a very limited view of the bigger picture. And yet, if you’re a retail investor, a Systematic Investment Plan (SIP) into the Sensex from Nov 2007 till now – or eight years – has given a cagr of 9%, which is only almost equal to the average inflation during that period. As for inflection points, while the NDA Government’s victory drove a rally in the markets, 1-year returns have steadily fallen since the peak in March 2015, as can be seen in the chart below.

Nifty - 1 year return

And now the good news…

India isn’t alone in lackluster equity returns. Emerging Markets (EM) equities, as a class, have been delivering dismal returns over the past few years; the iShares MSCI EM ETF is down 24% in the past 5years. In comparison, the Dow Jones Industrial Average is up 58% during the same period. The Institute of International Finance pegs net capital outflows from EMs at US$540bn – for the first time since 1988. Thus, following the Global Financial Crisis, the trade has been long Developed Markets, short Emerging Markets. This exodus follows concerns of rising debt and slowing growth among Emerging Markets such as Brazil, Russia, China, etc. combined with the upcoming Fed ‘lift-off’. In September, IMF Managing Director, Christine Lagarde, said, “The not-so-good news is that emerging economies are likely to see their fifth consecutive year of declining rates of growth."

Among this turmoil, India stands apart on improving economic prospects, as compared to other Emerging Markets. It is a beneficiary of lower crude and commodity prices and its largely domestic economy is fueled by fairly stable private consumption growth. At 7.4% in 2QFY16, India’s GDP growth is among the highest globally – in comparison, Brazil’s GDP growth declined 1.7%. Moreover, with its current account deficit and fiscal deficit largely under control, India remains relatively more attractive compared to other EMs.

More From This Section

What lies ahead?

All of this is known and in the price. The Nifty trades at 21x trailing earnings (as per NSE), which is at a premium to other EMs and to its own historic trading averages. India Inc. is in the midst of a slowdown with an uncertain recovery due only in the second half of next year. Most of India’s ailments are known – a bad-loan laden public banking system and weak industrial growth – and will take time to recover. The Government is cognizant of these problems and is taking steps – even if baby steps – to resolve them. No wonder then that despite the Nifty is now stuck in a stubborn trading range with no massive risk to the downside and no major trigger to the upside. The Fed ‘lift-off’, if anything, will remove an imponderable. Domestic economic growth can, at worst, remain moribund and, at best, commence a recovery in 2016.

Thus, trigger-less, lost and stuck in a range, India’s bear market is set to continue for a while. With its core story of growth intact, India will benefit from any panic-led EM crisis – warning: only in the long-term. And so, long-term investors should take heed of this because bear markets always offer opportunities, provided they have patience and persistence. A few years of underperformance will test both of these qualities for even the strongest of investors.

Anupam Gupta is a Chartered Accountant and has worked in Institutional Equity Research since 2000, first as an analyst and now as a consultant.

He contributes to the Business Standard platform, Punditry, through his blog, Beyond Markets on markets & the economic horizons.

He tweets as @b50

)