Greek savers have withdrawn about 2 billion euros from banks over the past three days, with outflows accelerating rapidly since talks between the government and its creditors collapsed at the weekend, three banking sources told Reuters on Thursday.

The spike piles more pressure on Greece's battered lenders and provides new evidence of the hit to the financial system and broader economy from the deadlocked negotiations.

The 2 billion euros taken out between Monday and Wednesday represent about 1.5 percent of total household and corporate deposits of 133.6 billion euros held by Greek banks as of end-April. Prior to this week, withdrawals had been running at 200-300 million euros a day.

A spokesman for the Greek central bank declined to comment, saying it releases data on deposits on set dates and would publish data for May on June 26.

Greek savers have been steadily pulling money out of banks since October.

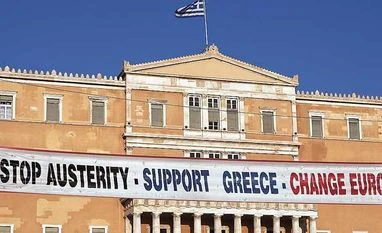

The weekend collapse of the aid-for-reforms talks between Greece and its euro zone and IMF creditors has left Athens on the verge of a default and raised the possibility of capital controls, something it has repeatedly denied it will resort to.

"The next two weeks are very very crucial for the country and the banks," one of the Greek banking sources said. "The government should secure an agreement as soon as possible".

However a Greek government official said there appeared to be a deliberate attempt to create economic instability for the benefit of the creditors and the government would not be blackmailed.

"The efforts made by those circles will fail. They will be resisted with calmness and resolve by the government and the Greek people," the unnamed official said.

Greece faces a 1.6 billion euro bill to the IMF on June 30 that it is not expected to be able to pay without a deal with its creditors.

Euro zone finance ministers were meeting in Luxembourg in the latest attempt to reach a deal, but any expectation of a breakthrough there had all but vanished with Athens ruling it out as a forum to discuss new proposals.

The ongoing crisis prompted an outflow of deposits of about 30 billion euros ($33.8 billion) from Greek lenders between October and April, the central bank says.

Unlike mass withdrawals in 2012 when Greece last flirted with bankruptcy, Greeks are keeping most of the money that has been withdrawn at home rather than sending it abroad, the central bank said in a monetary policy report on Wednesday.

"The ratio of deposit flight abroad over the total drop in deposits in the last months shows that a larger percentage of outflows is staying in the country," the central bank said.

(Writing by Deepa Babington; editing by Janet McBride and John Stonestreet)

You’ve reached your limit of {{free_limit}} free articles this month.

Subscribe now for unlimited access.

Already subscribed? Log in

Subscribe to read the full story →

Smart Quarterly

₹900

3 Months

₹300/Month

Smart Essential

₹2,700

1 Year

₹225/Month

Super Saver

₹3,900

2 Years

₹162/Month

Renews automatically, cancel anytime

Here’s what’s included in our digital subscription plans

Access to Exclusive Premium Stories

Over 30 subscriber-only stories daily, handpicked by our editors

Complimentary Access to The New York Times

News, Games, Cooking, Audio, Wirecutter & The Athletic

Business Standard Epaper

Digital replica of our daily newspaper — with options to read, save, and share

Curated Newsletters

Insights on markets, finance, politics, tech, and more delivered to your inbox

Market Analysis & Investment Insights

In-depth market analysis & insights with access to The Smart Investor

Archives

Repository of articles and publications dating back to 1997

Ad-free Reading

Uninterrupted reading experience with no advertisements

Seamless Access Across All Devices

Access Business Standard across devices — mobile, tablet, or PC, via web or app

)