As the country marches along the information highway, the demand for one particular item is running high.

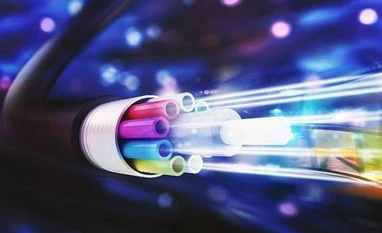

The past year has seen a massive jump in the use of fibre-optic cable, or bundled strands of cable made of ultrapure glass that can carry vast amounts of data quickly via light.

At present, telcos, internet service providers (ISPs), cable operators and the government consume over 20 million fibre kilometers annually. But over the next few years this demand is expected to more than double, and behind it is going to be the move to 5G in 2020.

This could prove to be a bonanza for the small fraternity of fibre-optic cable manufacturers in the country. The few large players in the business—Sterlite Technologies, Himachal Futuristic Communications Limited (HFCL), a clutch of MP Birla group companies —Vindhya Telelinks, Birla Cable and Birla Furukawa Fibre — Delhi-based Aksh Optifibre and multinational Corning are expanding furiously to meet the anticipated boom in demand.

Ankit Aggarwal, director of Sterlite Technologies, the largest player in the business, says: “From 20 million fibre kilometers, we expect the demand in the next two to three years to double to 35-40 million fibre kilometers. The market is booming.” The company closed FY 18 with its order book hitting a record Rs 52 billion, the highest ever, and with its share price nearly doubling at Rs 314 per share in the span of a year on the Bombay Stock Exchange.

Aggarwal says that based on the overall industry trends, the requirement for fibre increases three-fold once telcos move from 3G to 4G, which is still a work in progress, and as much as two to three times more when the migration to 5G happens.

This boom in domestic demand coincides with the upsurge in the global market, led by the insatiable requirement from China, which currently consumes 60 per cent of the global capacity. Exports are crucial to the growth of domestic manufacturers because nearly half their capacity is absorbed by China, Europe and the US. Overseas demand constitutes more than half of Sterlite’s capacity and it has a 5 per cent share of the Chinese market. Delhi-based Aksh Optifibre, on the other hand, has seen its exports as a percentage of revenues rise to 47 per cent in 2017, from 38 per cent a year ago. And the MP Birla group companies ship one third of their production to global markets.

Says Mahendra Nahata, chairman of HFCL, a major exporter of optic fibre: “While the total capacity of all players in India is around 40 million fibre kilometres, nearly half of it is exported. So, there is a shortage between demand and supply. As a result, many telcos are already importing.”

Nahata adds that due to the zooming global demand, there is a shortage of glass, the raw material to manufacture fibre (only Sterlite manufactures it in India) and prices have doubled in two years.

As the demand takes off, domestic companies are making substantial investments in increasing capacity. “Our order books are going full at the moment. We see a boom in the industry in the next two to three years due to huge roll-out by the government and telcos,” says R Sridharan, chief executive officer, Birla Cable Ltd, a part of the M P Birla group.

The group has put together an ambitious expansion plan in place to become future-ready. Birla Furukawa, a joint venture with Japan's Furukawa Electric, and Vindhya Teleniks are expanding fibre capacity by 1.6 times, while Birla Cables is ramping it up1.5 times.

Sterlite’s Aggarwal, meanwhile, has set his sights on becoming the third largest player in the world, with a 10 per cent share of the fibre market, from seventh currently. Towards this end, Sterlite is investing Rs12-Rs 15 billion to increase capacity by 20 million fibre kilometres per annum to hit 50 million. And HFCL, which supplies a large amount of cable to Reliance Industries’ telecom venture Jio, has decided to go in for backward integration (it currently manufactures only cable and not fibre) to make 6.4 million fibre kilomtres per annum in Hyderabad at an investment of Rs 2.5 billion.

The bulk of the demand for fibre optic from telcos and ISPs is arising on two fronts: one is to replace microwave communications (which is not capable of handling vast amounts of data) with fibre to backhaul towers (only 20 per cent have fibre) so that they can cater to the data explosion as the internet traffic soars with more users switiching to 4G.

According to estimates, Reliance Jio, Bharti Airtel and Vodafone would be spending up to 12 per cent of their capital investment in laying fibre, nearly double of what they forked out before. The three together are expected to invest over Rs 1,000 billion annually at least in the next two years.

The demand is also being fuelled by the move towards fibre-to-home services (FTTH). Jio, for instance, aims to connect 100 million households in at least 30 cities with last mile fibre connectivity. Bharti Airtlel, which already has three million broadband customers in 95 cities, is going in for a major expansion as well. But telcos are not the only ones that need fibre optic. Multiple System Operators, who offer broadcasting services to over 130 million homes, are replacing their copper cables with fibre so that they can compete with telcos in offering high-speed broadband apart from satellite channels to their customers.

Then, there is the demand from the government. Under the ambitious Bharat Net programme, the government plans to lay fibre optic cables underground to connect over 250,000 panchayats across the country by the end of 2019, and it has already completed half the work. For the next phase, industry estimates the government will need 300,000 fibre kilometres to make its vision of connected villages a reality. There is also the Smart Cities project, which envisions to equip 100 cities with modern digital infrastructure to control traffic and access government services. With the cities of the future being paved in glass, the demand for optical fibre is not going to be sated soon.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)