Higher operating expenses, interest cost and provisions for wages had an impact on the profits of PowerGrid, which for the December 2013 quarter reported 7.7 per cent year-on-year decline in net profit to Rs 1,042 crore. However, if the wage arrears of about Rs 160 crore booked in the revenues in the year-ago quarter are removed, profits have grown in excess of 10 per cent year-on-year. That apart, expenses also increased, leading to a 270 basis points drops in the operating margins to 84.3 per cent. However, R T Agarwal, director, finance, PowerGrid, says, “Most of these expenses are part of the overall cost, which are thus part of the return on equity which we make. Thus, we do not see these to have a major impact on the financials”.

In the case of companies like PowerGrid which have a business model where the real profits are based on the return on equity approved by the regulators, the margins do not matter as a result of the pass through mechanism. As the size grows and more and more projects require higher maintenance, the company will have to spend on the operations.

Meanwhile, despite the difficult operating environment and industry conditions, the company was able to make investments and grow its sales. During the quarter, sales were up 9.6 per cent year-on-year to Rs 3,685 crore. Importantly, the market’s concerns about the capitalisation of ongoing projects, especially in the light of huge capital work-in-progress in its balance sheet, are easing.

For the nine months ended December, the company has capitalised about Rs 13,000-crore worth of work-in-progress and is hopeful of achieving about Rs 17,000 crore of capitalisation this year, which is close to last year's figure. Achieving the target is important, especially in the light of the recent follow-on public offer (FPO) money the company raised from investors. If the company underachieves, the impact of equity dilution will be felt in large and that will keep its share price under pressure. But, analysts seem confident about the company achieving capitalisation and profit targets.

For one, in the first nine months, the company achieved 75 per cent of the expected profits in FY14.

Analyst are also looking at the company’s performance and prospects in the context of the present industry conditions wherein projects are not moving and venders are facing huge execution challenges because of the funding and other issues. Even if the company achieves the capitalisation target, it will be able to maintain its growth momentum, which in turn, will support stock valuations thereby rewarding the investors.

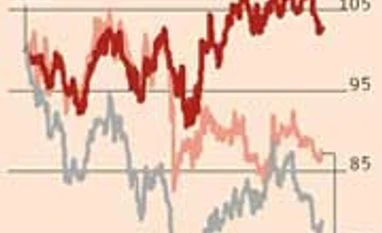

At Rs 96, most analysts believe that stock valuations of about 10 times FY15 estimated earnings are reasonable for a business generating a 15 per cent return on equity and offering a dividend yield of about three per cent.

In the case of companies like PowerGrid which have a business model where the real profits are based on the return on equity approved by the regulators, the margins do not matter as a result of the pass through mechanism. As the size grows and more and more projects require higher maintenance, the company will have to spend on the operations.

Meanwhile, despite the difficult operating environment and industry conditions, the company was able to make investments and grow its sales. During the quarter, sales were up 9.6 per cent year-on-year to Rs 3,685 crore. Importantly, the market’s concerns about the capitalisation of ongoing projects, especially in the light of huge capital work-in-progress in its balance sheet, are easing.

For the nine months ended December, the company has capitalised about Rs 13,000-crore worth of work-in-progress and is hopeful of achieving about Rs 17,000 crore of capitalisation this year, which is close to last year's figure. Achieving the target is important, especially in the light of the recent follow-on public offer (FPO) money the company raised from investors. If the company underachieves, the impact of equity dilution will be felt in large and that will keep its share price under pressure. But, analysts seem confident about the company achieving capitalisation and profit targets.

For one, in the first nine months, the company achieved 75 per cent of the expected profits in FY14.

Analyst are also looking at the company’s performance and prospects in the context of the present industry conditions wherein projects are not moving and venders are facing huge execution challenges because of the funding and other issues. Even if the company achieves the capitalisation target, it will be able to maintain its growth momentum, which in turn, will support stock valuations thereby rewarding the investors.

At Rs 96, most analysts believe that stock valuations of about 10 times FY15 estimated earnings are reasonable for a business generating a 15 per cent return on equity and offering a dividend yield of about three per cent.

)