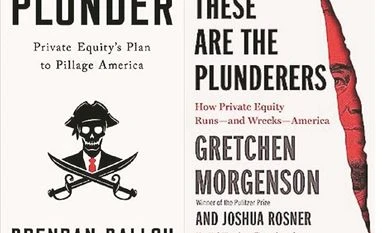

THESE ARE THE PLUNDERERS: How Private Equity Runs — and Wrecks — America

Author: Gretchen Morgenson and Joshua Rosner

Publisher: Simon & Schuster

Pages: 383

Price: $30

PLUNDER: Private Equity’s Plan to Pillage America

Also Read

Author: Brendan Ballou

Publisher: PublicAffairs

Pages: 353

Price: $30

In These Are the Plunderers: How Private Equity Runs — and Wrecks — America, by Gretchen Morgenson and Joshua Rosner, the arguments are about as subtle as a wrecking ball. It’s a measure of just how inflamed the rhetoric can be that when I arrived at the chapter called “Like When Hitler Invaded Poland in 1939,” I assumed the authors were the ones drawing the analogy. In addition to the “plunderers” of the title, their book is full of “money-spinners,” “buyout boys,” “pirates,” “pillagers” and “marauders”.

But it turned out that the line about Hitler’s invasion of Poland came from Stephen A Schwarzman, the chairman and chief executive of Blackstone, one of the world’s largest private equity (PE) firms. He said it in 2010, in response to President Barack Obama’s proposal to eliminate a tax loophole that favoured billionaires. Some of the billionaire behaviour depicted in this book is so self-regarding and over-the-top — spending $3 million on a birthday party — that I have to admit the overheated language isn’t entirely out of step with the world the authors describe.

Besides, Morgenson and Rosner marshal considerable evidence for their case, which is bolstered by another book that bears a similar argument and title: Plunder, by Brendan Ballou. Morgenson is a financial reporter for NBC News and a former columnist for The Times; Rosner is a financial analyst; Ballou is a federal prosecutor who served as special counsel for PE at the Justice Department. Both books show the damage PE can do. They describe how firms like Apollo Global Management, KKR and the Carlyle Group buy up companies using very little of their own money, load the companies with debt and then squeeze them for profits.

People in favour of PE will say that the firms serve a crucial function, making troubled businesses more robust and efficient. The authors of these books allow that this does happen, but they counter that the industry has grown so enormous, with so much money chasing the same deals, that many PE firms will acquire healthy companies and essentially make them sick, forcing them to pay off the money that was borrowed to buy them. The business model isn’t so much investment, Ballou says, but extraction. “Roughly one in five large companies acquired through leveraged buyouts go bankrupt in a decade,” he writes.

Toys “R” Us is such a vivid example of private equity’s predations that it appears in both books — a storied company that was bought by KKR, Bain and Vornado Realty Trust in 2005. By 2017, after years of layoffs, crushing debt and being charged regular management fees by the private equity firms “for the privilege to be owned by them,” Ballou writes, Toys “R” Us was bankrupt. (It has recently emerged from bankruptcy.) Ballou adds that the rise of online retail wasn’t as much to blame as people said it was. Toys “R” Us had steady sales and decent market share. But almost all of its operating income was going to service the interest payments on its debt (to say nothing of those preposterous management fees). The company went from having $2 billion in cash when it was acquired to having no money to maintain its stores.

If the results are bad when the product is toys, they can turn deadly when the product is care. PE firms have acquired nursing homes, provided staffing for hospitals and services for prisons. Morgenson and Rosner quote David Rubenstein, a co-founder of the Carlyle Group, whose acquisition of HCR ManorCare, a chain of nursing homes, ended with bankruptcy after years of cascading health-code violations.

There are so many outrages enumerated in these books that reading them may have you looking for a pitchfork, though I prefer Ballou’s crisp prosecutorial delivery to Morgenson and Rosner’s name-calling and sarcastic asides. Ballou also does an admirably clear job detailing how PE firms use legal wrangling to their advantage. They compel their customers into arbitration, while pursuing their own interests in the courts. And the firms are structured in a cleverly lawyered way to avoid liability. To take just one example: After a family sued Carlyle for the death of their loved one, a resident at a ManorCare facility, “Carlyle argued that it didn’t actually own ManorCare or its facilities,” Ballou writes. “Rather, it claimed, it simply advised a series of funds that did.”

Government, these books say, has been remarkably supportive of an industry that has helped hasten downward mobility and widen economic inequality. Lobbying and campaign contributions have done their part to ensure this support, Ballou says, along with the fact that senior government officials have found lucrative employment at PE firms after leaving public service.

This observation reminded me of a book about private equity that was published in 2010 by Josh Kosman, called The Buyout of America. Kosman began by imagining a scene in which President Obama, up for re-election, is faced with PE-owned companies starting to collapse because they have been saddled with so much debt. The bearer of this dire news in Kosman’s scenario is Obama’s unnamed Treasury secretary — who, at the time, happened to be Timothy Geithner. Little could Kosman have known that a few years later, Geithner would become the president of Warburg Pincus, whose website states up front: “Private equity is the firm’s only business.”

©2023 The New York Times News Service

)