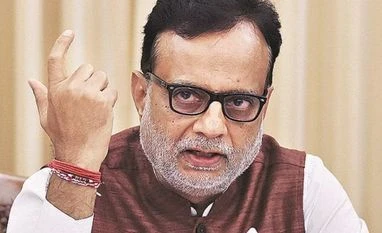

A day after the Budget presentation, Union Finance Secretary HASMUKH ADHIA tells Business Standard there were valid reasons for a pause in fiscal consolidation and the deviation is within an acceptable range. Edited excerpts:

Long-term capital gains tax has not gone down well with the markets. The Sensex tanked 500 points earlier in the day.

In the past so many days, on how many days hasn't the market fallen by this level? It is not such a deep fall.

Any possibility of a roll-back?

Why should we do so? There is no question.

Will there be a dilution of this tax?

No. It is a minimal tax we have put, after grandfathering it (the term for carrying over earlier benefits up to a specified date). It has come into effect prospectively, not retrospectively. There is no reason for anyone to go on a sell-off mode.

The government had taken a public position against protectionism but the Budget has increased customs duty on a number of products. Is it not double talk?

It is not protectionism of the kind other countries are doing. We are saying our MSME (micro, small and medium enterprises) sector is capable of making certain goods that other countries are trying to dump in India. It is very difficult for this sector to go to the anti-dumping authority and prove dumping. They do not have the wherewithal to contest an anti-dumping case. We are giving only marginal protection for that and not saying no import will be allowed.

But, this type of import substitution is now considered an obsolete and blunt tool...

Maybe at one point of time, but it is coming back. Most advanced countries are erecting only non-tariff barriers. Even today, duty in the US might be less but if you try to send a parcel of mangoes or fruit juices, these would not be accepted there, as their standards are so high. These countries are resorting to other sorts of protectionism.

The government has paused on the fiscal consolidation path for a second year. Don't you think it will not go down well with investors?

A major structural tax reform was carried out. Even the FRBM (Fiscal Reform and Budget Management) committee had recommended allowing 0.5 percentage point of slippage. We have not taken the full escape route; we have taken only a 0.3 percentage point of deviation. There is valid reason for doing so. Nobody should mind it if there is good reason for doing so and it is within a range.

The fiscal deficit has widened and with a higher Minimum Support Price (MSP) on crops, don't you think it will impact inflation?

I don't think so. Inflation has something to do with overall demand and supply of a commodity. When you give more MSP to farmers, the middlemen's share comes down but the final price remains the same.

But, an increase in fiscal deficit will impact inflation...

We have already accounted for various expenditures. We have accounted for various schemes in the fiscal calculation.

Could we expect an excise duty cut in oil?

I can't say. We will have to keep watching the situation.

How much was the global oil price assumed in the Budget calculation?

We made no assumption. We are at $65 a barrel. We will have to keep watching it.

The Budget has cut corporation tax to 25 per cent for all MSMEs. Experts say it will be disadvantageous for partnership and limited liability partnership (LLP) firms...

We want to encourage more partnership firms and LLPs to come in the company structure. Under the revised Companies Act, the compliance burden is also not so much. You register online, file one annual return online and that is all. So, we would like more entities to formalise as companies. We want to encourage more companies to come. Second, for a partnership firm, they get so many benefits that companies don't get. What a partnership firm does is take interest on capital and its partners can also take salary. So, the 25 per cent tax is not required for them.

The finance minister has said cryptocurrency is not legal tender. If so, why is there direct tax on it and will you impose the goods and services tax (GST) on it?

The principle of income taxation is if income is coming out of illegal transactions, it will be taxed. We are yet to discuss the GST aspect.

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

)