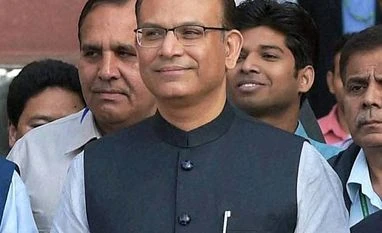

In a post-Budget interview, Jayant Sinha, the Union Minister of State, Finance, says the map for the national goods and services tax is on track and there will be changes in rates to ensure a smooth rollout. In a conversation with Jayshree P Upadhyay and Arup Roychoudhury, he speaks on this and various other issues in the national finances. Edited excerpts:

What are your biggest takeaways from the Budget?

We have to take all the stakeholders together, whether it is the farmers, youth looking for work or entrepreneurs. If entrepreneurs and industries don’t flourish, we cannot carry forward the social reforms. We need to develop the economy and put it on a par with the flourishing ones of the world, one that is globally competitive and driven by innovation.

Whether we talk about the regulatory regime, tax regime or quality of governance, we have to ensure performance on a par with the best economies of the world. We are trying to put in place a framework for the 21st century economy. We firmly believe that with this Budget, we have unleashed the third generation of reforms. Our economic thinking is very different from the earlier regime.

They believed in the policy of entitlement, we believe in empowerment. We want to give the people the tools and resources to demand a better quality of life. Our universal social security system is to ensure the poor and middle classes are financially covered.

While Arun Jaitley’s decision to delay the fiscal consolidation schedule by a year has been well-received, and the 2014-15 fiscal deficit target of 3.9 per cent of gross domestic product (GDP) is realistic, the fact is that the tax revenue and disinvestment targets are the highest ever. The taxman has consistently missed his target since 2009-10, stake sale targets are never met, and the Central share of the divisible pool is down. How will you ensure no slippage in your receipts?

On taxes, we are projecting an overall growth of 14 per cent, year over year. That is relative to the growth of 10 per cent we achieved this financial year, in a very challenging economic environment. We are expecting a higher GDP growth, whether on the basis of the old methodology or the new. On the excise side, we expect to mop Rs 60,000-70,000 crore this year if prices remain at this level.

Yes, the transfers to states out of the divisible pool are higher but not massively so. The important part is the manner in which it is being transferred to the states. It is completely untied money via the devolution route. This is the first ‘Big Bang’ reform in the form of cooperative federalism, changing the way the Centre and the states are sharing tax revenues. Let’s give money to the states and let them be accountable for the development and spending of the money.

On disinvestment, last time we started work only in July and yet we have achieved Rs 33,500 crore. This time, we have a full year and the experience of big stake sales like Coal India, which did very well. This time our focus is also on more strategic disinvestments and to get investors through innovative ways. We will consider everything that makes sense. However, as a seller, I would never tell you what I am about to sell.

You decided not to re-introduce customs duty on crude oil. What was the thinking? It would have been a good opportunity to increase indirect tax revenue.

Excise gives us better revenues at these price levels because there is also value-addition along the way. This gives us better revenue and a cushion to start rolling back excise when global crude prices once again inch up to $70-75 a barrel.

India as an economy has benefited by Rs 2.5 lakh crore and the Centre by Rs 1 lakh crore on account of falling crude prices.

The revenue-driven approach of the tax department is one of the biggest reasons for tax litigation in India. The TARC recommendations were to remove this approach. Any thoughts on that?

All those things are under consideration and we very well realise the problems in the system. This year, too, targets were given, and in a not-so-good economic condition. But the way the taxman worked was completely different. We had inherited a legacy of bad tax administration that led to problems with payers. There were overly aggressive targets and aggressive assessment. We have done 70 per cent more of refunds this financial year. This has been our initiative, to avoid this perverse cycle of refunds.

While oil subsidies are set to increase because of low global crude prices, the Budget shows food and fertiliser subsidies are actually up year-over-year. Is there a plan to rationalise the two items?

You have to go to the heartland of India, its villages, to see how people live. We need to make sure they have their basic needs met of food, fuel, minimum days of work. We need to move from Jan Dhan to Jan Suraksha. That is why we want to keep the subsidy levels to where they are. We have to figure out ways on how to better transfer these benefits, including direct cash transfer.

It is possible, through the JAM trinity (Jan Dhan, Aadhaar, Mobile), that we are much more targeted and leakage-proof in our subsidy transfers, and that itself will reduce our subsidy burden by 25-30 per cent. We are working hard on a new urea policy and there are many other proposals we are considering.

What things can be expected on the GST front to facilitate a smooth rollout? Can the April 1, 2016, deadline be met?

The road map is crystal clear. The first is the appointment of the empowered committee’s chairman. We will look to pass the GST constitutional amendment Bill in this session. Then it has to be passed by 50 per cent of the states. That will likely happen by June-July. Then the empowered committee will work with us to draft the GST Bill. That will be introduced in Parliament. Then the states will have to pass it in their legislative assemblies. So, the legislative roadmap is fairly complicated but at the same time, there is a widespread consensus on this issue.

Obviously, what will happen is that all indirect taxes will be subsumed in GST. A series of steps need to be taken in service tax and excise for a smooth rollout. We need to make sure goods and services come under the GST regime. Some increases we will have on service tax to get it at par with the revenue-neutral rate and we are working towards that.

Don’t companies have to be brought on board and prepared for the GST regime?

We have had enough of consultations and discussions with industries. The GST Network has been created to take care of that aspect, to explain to people how all of this is going to work.

What will be the purpose of the National Infrastructure and Investment Fund? Will it replace the National Investment Fund, which did not serve its purpose?

NIIF will have an annual flow of Rs 20,000 crore a year. It will be a government fund but with professional managers from the public and the private sector. NIF was only an account. The NIIF will be a professionally-run fund, to provide the push for public spending in infrastructure.

You need to amend the Reserve Bank of India Act to form a Monetary Policy Committee. By when can we expect the amendments to be moved and what is their likely form?

It is being worked upon. We will move the amendments sooner rather than later. You can expect it in one or two months. A number of sections in the RBI Act need to be changed. You can expect the details soon.

)