It is noticeable that the Budget estimates on the tax revenue front project a very conservative scenario. After nearly 17 per cent growth in gross tax revenues over the last two years the FY18 Budget estimates it at only 12.2 per cent. This leaves room for improvement in the aftermath of demonetisation, which can yield dividends directly from the Reserve Bank of India’s (RBI) balance sheet readjustments and indirectly from bank deposits, with the potential of formalisation of a part of the parallel economy.

Further, the overall 6.6 per cent increase in overall expenditure is being financed by a nominal growth of 11 per cent and tax buoyancy of 1.1 per cent compared to 1.9 per cent and 1.4 per cent in FY16 and FY17 respectively.

The limited giveaway on the tax front, that is, marginal relief to the low-income group between Rs 2.5 lakh and Rs 5 lakh and five per cent tax reduction to MSMEs is also well-targeted, reaching out to the segment that has been the most impacted due to demonetisation.

The government has showcased disciplined execution of its expenditure plan in FY17 contributing considerably to gross domestic product (GDP) growth. It is expected that such discipline will continue. Despite the fact that total spending and revenue expenditure as percentages of GDP are estimated to be at a record low, the mix of revenue and capex has been tweaked as also aligned with the government’s resolve to check inflation. The RBI may then be encouraged to reduce rates — yielding cheaper credit access to the private sector, an imperative for sustainable growth.

The Budget remains bold in re-emphasising its resolve to address the menace of black money, with landmark proposals for transparency in electoral funding by restricting cash funding and institutionalising anonymous funding through the introduction of bonds.

It is heartening that many proposals, which were part of the Justice Easwar Committee on Income Tax Simplification, have been addressed — reassuring taxpayers of a consultative approach that has become the hallmark of the tax legislative process recently.

The anti-abuse proposal on the tax front remain bold and direct. The proposal to curb the long-term capital gains (LTCG) tax exemption post introduction of the securities transaction tax (STT) in 2004 only to cases where both the legs of acquisition and disposal have suffered such STT is well intentioned. Supplemental notification, exempting genuine transactions from the clutches of any unintended consequences of this proposal, that is, acquisition of shares through initial public offering, follow-on public offering, bonus or right issue, etc will be eagerly awaited to ensure it is broad-based enough to carve out transactions of succession, contributions to trusts and many more.

Further, proposals such as the retrospective clarifications provided on applicability of the indirect transfer taxation provisions to foreign portfolio investors (FPI), further foreign direct investment (FDI) liberalisation and abolishing of the Foreign Investment Promotion Board are significant messages to attract foreign capital.

Much-needed clarity on minimum alternate tax (MAT) applicability post Ind AS adoption has been provided, building largely on the recommendation of the committee constituted in this regard. The proposals are premised on the basis that existing adjustments provided in MAT computation shall be made to net profits before other comprehensive income. The resultant will be further adjusted as now proposed for items in other comprehensive income as also the transition adjustments. What may need some clarification is that with regard to fair-value adjustments that are mandated through the profit and loss account in Ind AS. Such adjustments, both losses and profits should be treated similarly if the same are considered eligible adjustments to distributable profits. This may have been an inadvertent miss considering the matter rests between the Central Board of Direct Taxes and the Ministry of Corporate Affairs.

Continued commitment to spend on infrastructure development was evident in the Budget, with Rs 3.96 lakh crore spending in 2017-18. The thrust on affordable housing and stepped-up investments in road, highways and railway infrastructure are expected to spur economic activity and job creation. Further, measures providing income security to farmers, improving skill development and job creation at the rural level, in addition to affordable housing, are crucial for inclusive growth. Legislative reforms are also being contemplated for consolidation of labour laws to foster a conducive labour environment.

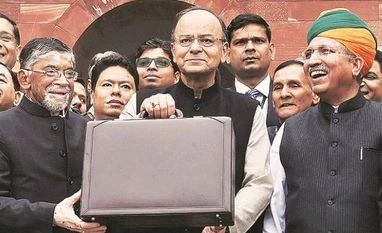

The FM has performed commendably to table proposals, which address the needs of India’s economy in today’s global and domestic environment. The Budget sends out key messages on continuity in the policy of fiscal prudence and resisting counter-cyclical measures to artificially boost the economy, consistency of purpose, drawing unshakably from the economic agenda set out in the manifesto, boldness of reforms resisting socio-political hostility, pushing India towards a more digital and cashless economy and certainty in tax through a collaborative approach. The FM’s implicit message cannot be missed by any serious foreign investor seeking to place bets on the most promising of developing economies.

The author is chairman, EY India

To read the full story, Subscribe Now at just Rs 249 a month

Already a subscriber? Log in

Subscribe To BS Premium

₹249

Renews automatically

₹1699₹1999

Opt for auto renewal and save Rs. 300 Renews automatically

₹1999

What you get on BS Premium?

-

Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

-

Pick your 5 favourite companies, get a daily email with all news updates on them.

Full access to our intuitive epaper - clip, save, share articles from any device; newspaper archives from 2006.

Preferential invites to Business Standard events.

Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

Need More Information - write to us at assist@bsmail.in

)