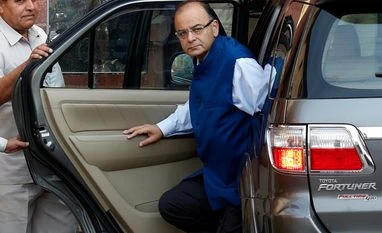

Here's a look at all the key measures Finance Minister Arun Jaitley proposed and missed for the technology sector in the Union Budget for FY16, and what the industry player have to say about it.

Self-Employment and Talent Utilisation (SETU) to be established as Techno-financial, incubation and facilitation program to support all aspects of start-up business. Rs 1,000 crore to be set aside as initial amount in NITI.

“The govt seems to have spoken of another Rs 1,000 crore startup fund with no news about the previous Rs 10,000 crore startup fund that was announced during the budget last year. Rather than announcing such funds, more focus needs to be given on how utilisation of such funds have impacted job creation and then additional support that can be provided for the same.”

- Alan D Souza, CEO of Bengaluru-based startup Vavia Technologies

- Alan D Souza, CEO of Bengaluru-based startup Vavia Technologies

Rate of Income-tax on royalty and fees for technical services reduced to 10% from 25% to facilitate technology inflow.

“The reduction in TDS for royalties will encourage knowledge transfer and will be a very powerful element together with other skill development initiatives announced today. It will truly help monetise the demographic dividend through skill development with a specific inclusive focus on people from rural areas.”

- Sanjoy Sen, Doctoral Researcher, Aston Business School, UK

- Sanjoy Sen, Doctoral Researcher, Aston Business School, UK

Domestic transfer pricing threshold limit increased to Rs 20 crore from Rs 5 crore

More From This Section

“From Transfer Pricing perspective, the one announcement in the budget proposals will surely aid in reduction of compliance for companies benefiting from this. It is important to mention that the previous budget covered a number of positive developments on transfer pricing like introduction of the range, use of multiple year data for comparability, roll back of Advance Pricing Agreements etc for which the tax payers are yet awaiting the rules to be announced.

- Rohan Phatarphekar, Partner and Head of Transfer Pricing, KPMG in India

- Rohan Phatarphekar, Partner and Head of Transfer Pricing, KPMG in India

No mention of e-commerce, despite the sector witnessing hyper growth

“The budget was a disappointment for this e-commerce sector as there was no specific measures to address the regulatory challenges faced by this sector in terms of VAT and investment guidelines. We hope that these would be addressed through GST. E commerce is the way of future and the government needs to address this sector’s unique and different needs whilst forming all its policies.”

- Harish H V, Partner, Grant Thornton India LLP

“Today I see a lot of young entrepreneurs running business ventures or wanting to start new ones. They need support so that they become job creators instead of job seekers,” Jaitley said in his Budget speech

- Harish H V, Partner, Grant Thornton India LLP

“Today I see a lot of young entrepreneurs running business ventures or wanting to start new ones. They need support so that they become job creators instead of job seekers,” Jaitley said in his Budget speech

“We’re happy with government's increased focus and recognition towards the Indian Start up industry. Over the last few years, the Indian Start up industry has witnessed tremendous success in providing innovative services to the nation, along with generating substantial employment opportunities . The additional focus towards the strengthening of the IT infrastructure, the backbone of the Indian start up industry will accelerate the industry growth.”

- Shashank ND, Founder & CEO, Practo

- Shashank ND, Founder & CEO, Practo

No direct measures for online consumer companies

“This is the first completely independent budget from Jaitley and industry had high expectations from it. While overall it seems to be pro-development but a lot more could have been done specially to boost the already booming start-up environment in the country. What will be interesting to see over the next couple of years is how well are initiatives like the incubation cell and 'nayi manzil' executed. We have seen in the past that governments have been good at announcing schemes but have hardly been able to execute them well.

- Rohit Chadda, MD and Co-Founder - foodpanda

Online central excise and service tax registration to be done in two working days.

“Simplifying process of regulatory permissions by bringing 14 regulatory permissions in one portal will help start-up entrepreneurs to set up their ventures very quickly and scale up their enterprise."

Online central excise and service tax registration to be done in two working days.

“Simplifying process of regulatory permissions by bringing 14 regulatory permissions in one portal will help start-up entrepreneurs to set up their ventures very quickly and scale up their enterprise."

- Manvejeet Singh, MD & Founder, Bestdealfinance.com said.

)