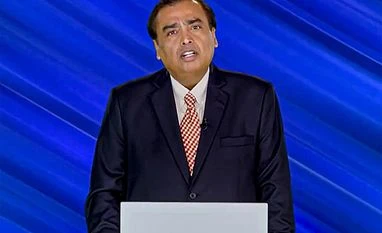

Mukesh Ambani, the patriarch of Reliance Industries (RIL), and Gautam Adani, the chairman of Adani Group of companies, have secured the top positions on the Fortune India Rich List, created in partnership with Waterfield Advisors, with respective wealth of $99.7 billion and $63.71 billion.

With a wealth of $34.6 billion, the Mistry family of Shapoorji Pallonji Group holds the third position on the list, while the Poonawalla family, owners of vaccine maker Serum Institute, with a wealth of $32.9 billion, stands fourth. Stockbroker and founder of D-Mart-branded grocery stores, Radhakishan Damani, claims the fifth spot on the India Rich List with a wealth of $23.4 billion.

The Who’s Who of India Inc, including the Shiv Nadar family, Azim Premji, Godrejs, Bajajs, and Kumar Mangalam Birla, have made it to the top 10 rich list.

With the listing of the financial services business, the Ambani family has initiated the process of unlocking value at the flagship RIL. The company plans to unlock value in two more businesses — telecommunications and retail — in due course, thereby increasing the wealth of its shareholders in the future.

Adani’s fortunes have made a sharp comeback since January this year after US-based short-seller Hindenburg Research accused the group of market manipulation. The group denied the charges, and the Adani family sold shares in several listed companies to prepay debt at the promoter level. Since March this year, the shares of Adani’s 10 listed companies have recovered, though they still remain below their all-time peak reached in September last year.

Among the top five families, the Mistry family, which derives its wealth from an 18.4 per cent stake in Tata Sons, the holding company (holdco) of Tata Group, is going through turbulent times as it plans to raise funds by listing Afcons Infrastructure and selling Gopalpur Port. The group has pledged its stake in its holdcos, which own Tata Sons, to raise funds and repay bank loans.

More From This Section

The magazine states that the wealth estimate of Indian billionaires is based on stock prices as of July 14, 2023, and shareholding as of December 2022. The rupee-dollar exchange rate considered is Rs 82.17 to a dollar as of July 14, 2023.

The magazine also mentions that the list ranks entrepreneurs of both listed and unlisted companies by their wealth. It has reached out to each individual and business family on the list to seek details of their listed and unlisted assets. The magazine has also requested additional information regarding investments outside of the listed business, such as stakes in other public companies (where the holding is less than 1 per cent) and in other private entities or start-ups, real estate, automobiles, jewellery, overseas assets, and cryptocurrencies.

In cases of families where there is no formal split despite individual family members running independent businesses, the wealth is consolidated under the current head of the family or immediate successor. In most cases, the wealth of siblings and spouses is combined, as in the case of the Bajaj family, which derives its wealth from Bajaj Auto and Bajaj Finance.

)