Mukesh Ambani-run Reliance Industries Ltd (RIL) on Friday reported a 10.8 per cent dip in its net profit for the June quarter (Q1FY24) owing to weak profitability seen in the oil-to-chemicals (O2C) business.

However, RIL’s telecom and retail businesses aided profitability, with an additional big push from a surge in other income.

For Q1FY24, RIL’s consolidated net profit was Rs 16,011 crore. Revenue from operations for the same period was reported at Rs 2.07 trillion, down 5.2 per cent on a year-on-year (YoY) basis, which the management attributed to a sharp decline in the O2C revenues with a 31 per cent fall in crude oil prices.

“However, this is partially offset by continued growth in consumer businesses and increase in volumes from O2C and Oil & Gas business,” the company said in its statement. RIL’s other income for the quarter under review was Rs 3,813 crore, up 70 per cent from a year ago.

In a Bloomberg poll, seven analysts estimated adjusted net income at Rs 16,995 crore and 14 expected the company’s revenue to be around Rs 2.137 trillion. Ebitda (earnings before interest, tax, depreciation and amortisation) for the quarter, the company said, was Rs 41,982 crore, up 5.1 per cent.

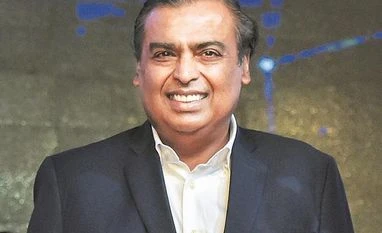

The company said Ebitda growth was led by the consumer and upstream businesses, which offset the decline in O2C earnings. “Reliance’s strong operating and financial performance this quarter demonstrates the resilience of our diversified portfolio of businesses that cater to demand across industrial and consumer segments,” said Mukesh Ambani, chairman and managing director.

Revenue for the O2C business was down 17.7 per cent at Rs 1.33 trillion and Ebitda for the segment took a hit of 23.2 per cent at Rs 15,271 crore. Exports from this segment declined 28.2 per cent to Rs 69,006 crore.

Also Read

“O2C had an exceptionally strong year-ago quarter with dislocation in energy markets driving margins to all-time highs,” said Srikanth Venkatachari, chief financial officer, in a press briefing after the results.

He added the O2C business was impacted by a 60-70 per cent decline in fuel cracks and a weak Polyvinyl Chloride (PVC) delta.

Demand for downstream chemicals from China has been slower than expected, said Venkatachari, and added India’s demand for fuels and chemicals remained strong.

Revenue from RIL’s oil and gas segment was up 27.8 per cent at Rs 4,632 crore, which the company attributed to higher gas price realisation and increase in KGD6 volumes with the beginning of oil and condensate production at its MJ fields.

Average gas price realisation for KGD6 was $10.81 per MMBTU for the quarter. Ebitda for the oil and gas segment was up 46.7 per cent to Rs 4,015 crore. The company expects volatility in global gas prices to continue in 2023 due to demand uncertainties in Europe and Asia.

Company officials expect a recovery in Chinese demand in the second-half.

Reliance Retail saw its net profit increase 18.8 per cent year-on-year (YoY) rise to Rs 2,448 crore in the June quarter. Jio Platforms registered a net profit of Rs 5,098 crore, up 12.53 percent from a year ago.

For the first quarter this financial year, RIL’s capital expenditure was Rs 39,645 crore. As of June 2023, the company said its consolidated outstanding debt was Rs 3.18 trillion, with finance costs up 46 per cent at Rs 5,837 crore for the quarter under review.

)