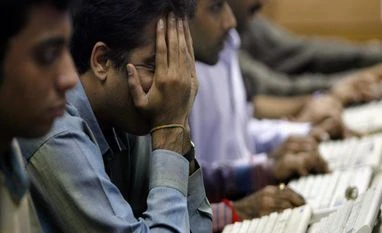

Stock Market Highlights: The frontline indices succumbed to aggressive selling in late deals, mainly in IT ahead of TCS and HCL Technologies Q1 earnings. Investors also preferred to keep positions on the lighter side ahead of the inflation numbers in India and later tonight in the US.

The S&P BSE Sensex dropped to a low of 65,320 – down nearly 500 points when compared to the day’s high of 65,812. The Sensex eventually ended with a loss of 224 points at 65,394. The NSE Nifty swung in a range of near about 150 points, before settling 55 points lower at 19,384.

Among the Sensex 30 shares, Infosys, Tata Motors and UltraTech Cement declined over a per cent each. NTPC, IndusInd Bank and Larsen & Toubro were the other prominent losers. On the other hand, Kotak Bank, Asian Paints and Sun Pharma finished on a positive note.

That apart, shares of TCS and HCL Technologies slipped 0.5 per cent and 0.7 per cent, respectively, ahead of their Q1 results later today. HDFC signed-off its last trading day on the bourses with a loss of 0.6 per cent on the BSE.

The broader indices, however, bucked the trend. The BSE MidCap and SmallCap indices were up 0.5 per cent each.

Shares of online gaming were in focus after the government imposed 28 per cent GST. Delta Corp nose-dived nearly 28 per cent in intra-day deals, and finally ended 23.3 per cent lower. Nazara Technologies tumbled over 14 per cent in early deals, but eventually recouped losses and was down 3.2 per cent at close.

READ MORE Primary Market Update

Utkarsh Small Finance Bank IPO was subscribed 3.2 times as of 03:45 PM on Day 1 of the offer period. Retail portion received bids up to 10.5 times, HNIs (Non-institutional segment) 4.7 times and Employee 2.1 times. Most brokerages recommend ‘Subscribe’ rating on the IPO.

Here’s why )