Shares of Century Enka hit a record high of Rs 863.90, as they surged 12 per cent on the BSE in Wednesday’s intra-day trade in an otherwise range-bound market on improved business outlook. The stock of Aditya Birla Group Company surpassed its previous high of Rs 798 touched on August 12, 2024. In comparison, the BSE Sensex was down 0.03 per cent at 80,782 at 10:20 am.

Century Enka is engaged in the manufacturing and selling of ‘Synthetic Yarn’ and related products. In the past four weeks, the stock has zoomed 60 per cent from a level of Rs 529.25 on July 23. Since April, thus far in the financial year 2024-25, the market price of the company more-than-doubled or zoomed 115 per cent from Rs 401.

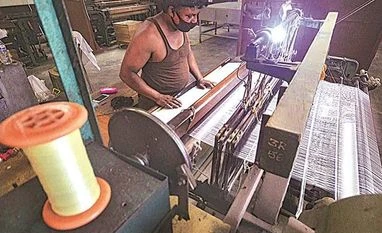

Century Enka makes customised Nylon tyre cord fabric (NTCF) for reinforcement of tyres which are used in motorcycles, scooters, light commercial vehicles (LCVs), medium & heavy commercial vehicles (MHCVs) farm and off the road (OTR) vehicles. It also produces a wide range of High-Quality Nylon Yarns used for varied applications including fishtwines, conveyor belts, sports and active wear, sarees, intimate and foundation wear, etc.

For the April to June quarter (Q1FY25), Century Enka reported a solid performance with a 80 per cent year-on-year (YoY) jump in consolidated profit at Rs 24.3 crore. Revenue from operations grew 23.2 per cent YoY at Rs 486.90 crore. Earnings before interest, tax, depreciation and amortization (EBITDA) margin improved 276 bps to 7.78 per cent from 5.02 per cent in Q1FY24.

Easing inflation and expected normal monsoon are expected to boost rural demand leading to better two-wheeler and farm tyres demand and increase in discretionary spends. These augers well for demand of both NTCF and Nylon Filament Yarn (NFY).

The company has successfully commissioned spinning capacities for Polyester High Modulus Low Shrinkage (HMLS) yarn in March 2024 and will start process of approval for Polyester Tyre Cord Fabric (PTCF). Significant Capex to increase NTCF capacity and diversification in PTCF along with new capacities of value-added products, modernization of the plants and augmented capacities will help the company in delivering superior results, the management said.

In the domestic market, the infrastructure growth, and incentives from Government on EVs is expected to provide added impetus to the industry. OTR & Farm has shown promising potential aided by modernization and overall economic growth. Increasing exports of automobiles particularly two wheelers also augers well for tyre demand, the company said.

More From This Section

The Indian government’s Make in India campaign, which aims to promote domestic manufacturing, is also expected to drive the growth of the textile industry and the demand for nylon filament yarn in the country. Overall, while the Indian nylon filament yarns industry is expected to experience moderate growth in the coming years. The industry needs to focus on meeting changing consumer preferences for profitable growth, Century Enka said in FY24 annual report.

)