The dimension of physical pain for human beings range from a minor back pain to low back pain, back pain, osteoarthritis/rheumatoid arthritis, joint pain, muscle pain, neuropathic pain, Phantom Limb Pain, Stump Pain, brachial plexus avulsion, differentiation pain, facial pain, complex regional pain syndrome, etc. In most diseases, painkillers are a part of every doctor’s prescription. As a practice, generic versions of existing and available pain killers are prescribed by doctors for the masses. Newer drugs in this area like the ‘Cox’ inhibitors perished and made drastic impact on the sales of companies which sold those leaving companies and doctors to resort to the traditional diclofenac and combinations.

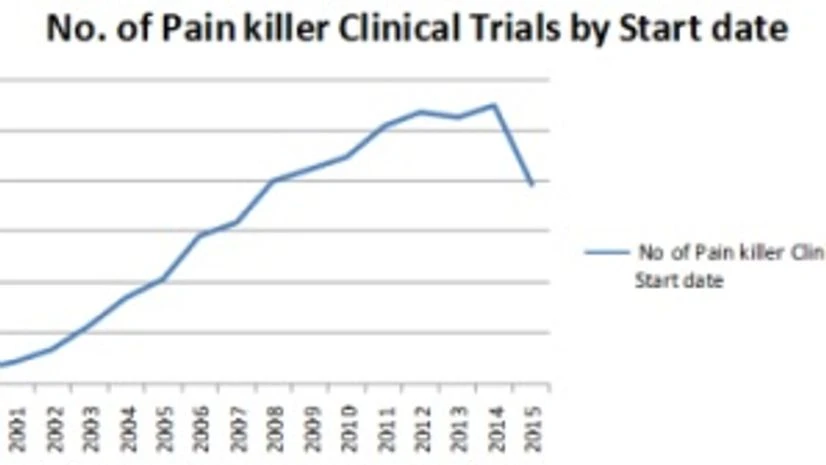

Data collection from the www.clinicaltrials.gov has listings of pain killer trials since 2000. From 2000, pain killer research grew at an ever increasing pace and year on year growth rates of the market maintained levels of 40-50 percent till 2006-2007. Growth rates in the pain killer research markets stabilised in the years 2008-2011 and the market continued to grow in the range of 10-20 percent. Post 2011, with ever increasing costs of clinical development which were affecting major therapeutic areas, the pain killer market was not an exception. The market fell to a low growth scenario as pharmaceutical companies started diverting or slashing their budgets for other profitable ventures.

Figure 1: Number of pain killer clinical trials by start date; Source: www.clinicaltrials.gov

As per www.clinicaltrials.gov data, pain killer research trials have grown at an average rate of greater than 20% since the last 15 years (2000-2015).

Clinical trials registered at start date on www.clinicaltrials.gov) since the last 15 years (2000-2015) show that a major percentage (approximately 54 percent) of them are registered in the phases 1-4. In 46 percent of the clinical trials for pain killer research, the phase of the trial is not mentioned. This can be attributed to various reasons like non-availability of funds, non-availability of the investigator and related reasons. Most of the clinical trials for pain killer research registered at www.clinicaltrials.gov are funded by a mix of academic investor, investigator and industry sources. Only 23 percent of the clinical trials registered for pain killer research are funded exclusively by industry, ie pharmaceutical companies.

Figure 2: Pain killers clinical research by phase; Source: www.clinicaltrials.gov

ALSO READ: CNS drug research: A dilemma for big pharma companies

Once the drug compound crosses phase 0 into phase 1, the risk portfolio for the drug phase takes a different proportion. The product is tested on healthy human volunteers after being ‘proved’ safe in animals. Phase 1 is the most critical phase in pain killer research. Pain killer drugs which are clinically tested on humans in this phase may or may not get into phase 2 for a significant time. The reasons for these may be related to lack of volunteer availability in the region where the trials is being conducted, changes in clinical trial design, safety parameters enforcements by the regulatory bodies or a lack of continuous funding.

Phase 3 and phase 4 in pain killer research may become even more challenging for pharmaceutical companies as these involve very large number of patients across specific geographies and need to be done in accredited hospitals. The process is followed by large volumes of data collections, followed by quality control and regulatory approvals based on the guidelines mentioned in the clinical trial protocol.

Exclusive industry funded trials in pain killer research are present in phase 2, phase 3 and phase 4 of the clinical research. In the others section of clinical trial listing in pain killer research, industry may contribute in initial stages with other sources of funding, or with academics or with organisations which are a bridge between clinical research of academic and industrial dimensions. In the phase 2 of pain killer research, the ratio of industry to other sources of funding is in the ratio of 50:50 but in the areas of phase 3 clinical trials for pain killer research, the funding ratio of industry funded trials is more than 50%. Industry oriented pain killer research is the growth driver for this therapeutic area.

Rashmi Pant

The RReACT database has complete information related to all analgesic clinical trials listed on www.clinicaltrials.gov for 3 of the most frequently studied chronic pain disorders - postherpetic neuralgia (PHN), fibromyalgia and diabetic peripheral neuropathy. For each disorder, trials meeting the search criteria are listed and linked to the www.clinicaltrials.gov registration page through the unique study National Clinical Trial (NCT) code.

The RReACT database has a total of 373 trials for postherpetic neuralgia, fibromyalgia, and diabetic peripheral neuropathy that met criteria for the RReACT database were registered on www.clinicaltrials.gov as of December 1, 2011.

Funding is difficult to come by for pain killer research. Therefore individuals, investigators, regulatory bodies and pharmaceutical companies are coming together to collectively take initiatives for pain killer clinical trial registrations since challenges of data collection for pain killer research trials is high as compared to any other therapeutic area.

____________________________________________________________________________________________________

Rashmi Pant is an expert in market research with more than 15 years of experience in major industrial sectors. She is also the owner of HOW TO: http://www.rashmipant.com/

)