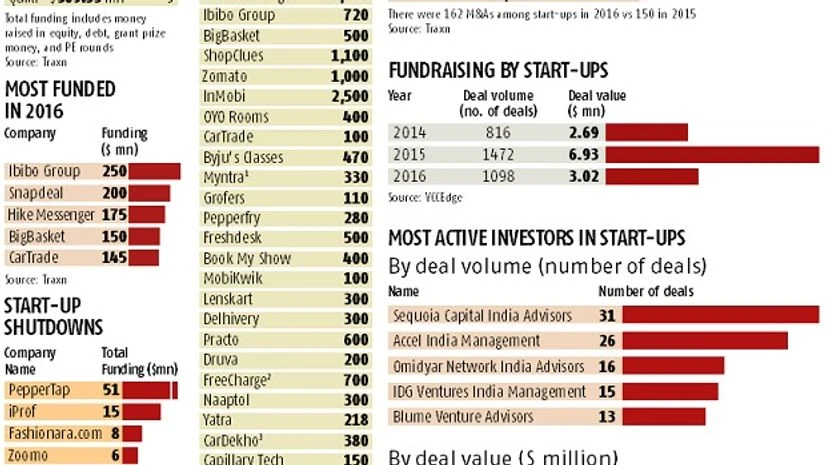

Year 2016 was depressing for start-ups, as they were forced to tighten their belts, reduce cash burn and extend their runways. Many start-ups, which had bloated their teams with easy money, found it difficult to shrink and fire people. Few ventured out to raise money as investors had turned wary and chose to focus on their portfolios. The funding boom from mid-2014 to mid-2015 was led by excess liquidity as investors raced to acquire a pie of the Indian consumer internet story. This drove valuations and saw start-ups raising $6.93 billion in 2015.

Valuations had run ahead of fundamentals and investors slowed down from mid-2015. Investors asked start-ups to conserve cash and improve unit economics. Start-ups that ran out of money or did not have a clear business model shut shop; some tried to pivot, while others with good teams or technology got acquired by more well-funded start-ups. Year 2016 saw 162 shutdowns and 212 mergers and acquisitions. This will continue. Year 2017 may see down rounds (when a firm raises money at a valuation lower than the previous funding round) as start-ups which had raised capital in 2015 come back to raise money.

start

)