Canadian pension fund manager Caisse de dépôt et placement du Québec (CDPQ) has invested around $155 million (around Rs 1,000 crore) to acquire stake in TVS Logistics Services Ltd. (TVS LSL), a third-party logistics service provider and part of TVS Group.

Besides this, the promoters have also pumped Rs 200 crore into the company.

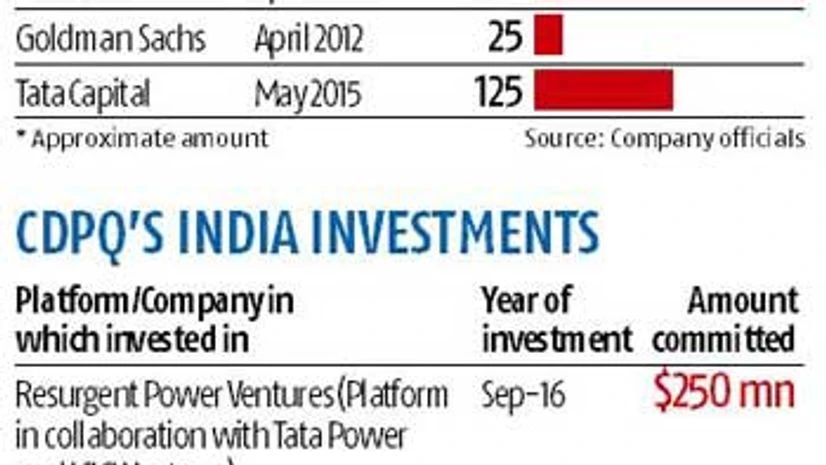

CDPQ will invest this money to acquire a sizeable minority stake in TVS Logistics Services. After this transaction, Goldman Sachs and KKR will exit their investments in TVS Logistics Services. CDPQ will purchase most of their joint stake, while the TVS family members and management will buy the remainder.

The transaction is subject to the approval by the respective boards and by the Competition Commission of India (CCI). While both companies declined to share information on the stakes to be transferred, sources said Goldman Sachs and KKR held around 21 per cent each in the company.

CDPQ said at a later stage it was ready to commit significant additional capital to finance transformative acquisitions and support the expansion of TVS Logistics Services in India and globally.

The new investor comes at a time when TVS Logistics Services is getting ready for second phase of growth. The company has set a target of $3 billion over the next three years.

Last year, the company clocked Rs 4,200 crore revenue and it expects to close 2016-17 with a revenue of Rs 5,700 crore, according to R Dinesh, managing director, TVS Logistics Services.

TVS Logistics has a strong global track record of growth, both organically and through acquisitions. Earlier, the focus of TVS Logistics Services was predominantly in automobiles, but it has started catering to e-commerce, defence and other sectors.

The company had benefitted from its partnership with Goldman Sachs and KKR, said Dinesh, adding that CDPQ would be a long-term partner.

TVS Logistics Services will continue look at acquisition opportunities. Dinesh said future acquisitions would be mainly for market and customer access, while the previous acquisitions were more for know-how.

)