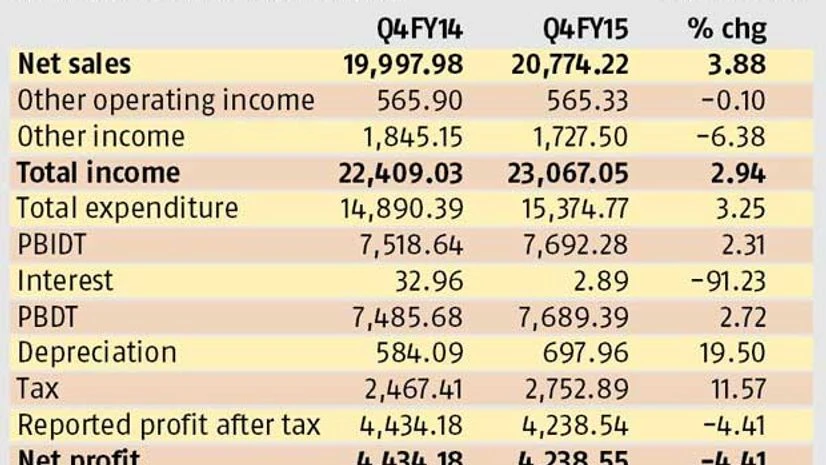

Hit by a rise in employee cost and contractual expenses, state-owned Coal India Ltd (CIL) reported a 4.4 per cent drop in consolidated net profit to Rs 4,239 crore for the quarter ended March, compared with Rs 4,434 crore a year before.

Net sales for the period, however, rose 3.9 per cent to Rs 20,774 crore from the Rs 19,998 crore in the year-ago period, on the back of higher output and offtake.

Employee benefit expenses rose 13.4 per cent to Rs 8,034 crore. Contractual expenses were Rs 2,805 crore, up 30.6 per cent from the corresponding period of 2013-14. Consolidated net profit for all of 2014-15 rose to Rs 13,727 crore from Rs 15,112 crore in 2013-14. Net sales rose 4.7 per cent to Rs 72,015 crore, from Rs 68,810 crore the previous financial year.

Also the world single largest coal producer, it missed the production target for 2014-15 by three per cent, recording 494.2 million tonnes. The target was 507 mt. Actual lifting of coal by consumers for 2014-15 was 489.3 mt, short six per cent of the target.

Output target for 2015-16 is 550 mt, about 11 per cent higher. It has begun the year on a strong note, with a rise in production of 10.7 per cent in April over the same month in 2014, at 41.5 mt; offtake was 43.5 mt.

“Also, we expect e-auction volumes to go up in accordance with a higher offtake. This should have a positive impact on the bottom line this year,” said an official.

The government has allowed CIL to revert to the earlier system, removing the cap on e-auction volumes with effect from April.

This means e-auction sales will account for about a tenth of the total, as was the case before the coal ministry put a seven per cent cap in September 2014. While a small part of overall volume, e-action sales contribute 35-40 per cent of total operating earnings.

The company's shares closed at Rs 383.10 on Thursday at the BSE exchange, up 0.7 per cent from Wednesday's close.

)