With global crude oil prices at a six-and-a-half year low, upstream oil and gas companies like the state-owned Oil and Natural Gas Corporation (ONGC) and private sector Cairn India need to brace up for an impact on their realisations, experts say.

Tracking the sell-off in global equity markets, benchmark Brent crude on Monday fell below $45 a barrel for the first time since March 2009. Brent crude for October delivery fell $1.79 on London's Inter Continental Exchange to $43.69 a barrel. In response, while the stocks of ONGC, Oil India (OIL) and Cairn India fell to 52-week lows, they recovered slightly on Tuesday with the three closing 1.5 per cent, 2.6 per cent and 2.8 per cent higher, respectively, following a marginal improvement in global crude prices. Brent crude also settled 2.8 per cent higher at $43.95 per barrel.

While upstream firms' realisations were impacted in the June quarter due to fall in oil prices, the easing of subsidy sharing burden meant net realisation impact were moderated. "However, with the oil prices coming down below $45 per barrel, their bottom-line will get hugely impacted in this quarter," said Debasish Mishra, senior director at consultancy firm Deloitte.

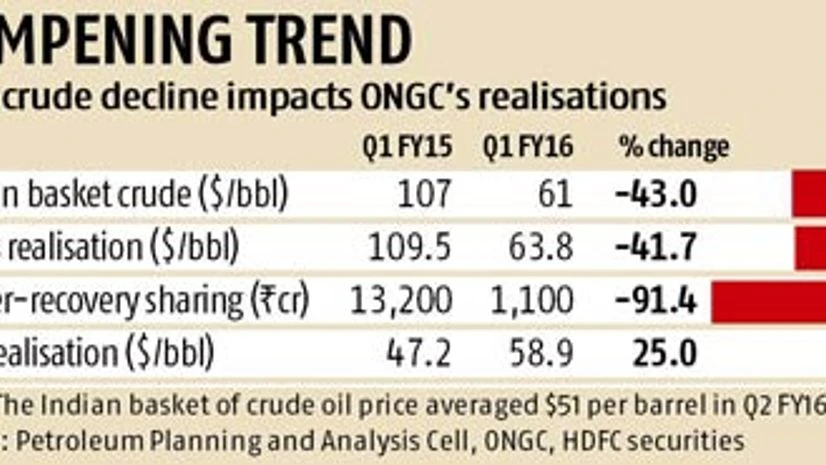

ONGC witnessed a 41 per cent drop in its gross realisation to $63.8 per barrel in the June quarter. However, the silver lining was 91 per cent fall in subsidy sharing to Rs 1,100 crore, which resulted in net realisation to $58.9 per barrel compared with $47.2 per barrel in the same quarter last year.

With the crash in the global crude oil prices, the realisations would come under further pressure. The Indian basket of crude, which stood at $42 per barrel on Monday, has averaged around $51 per barrel since the beginning of the September quarter in July. Mishra said the recent developments are hinting at oil trying to find a new trading range and not going to bounce back to three digits in a hurry. Lower crude prices will reduce total under-recoveries and, as a result, ONGC's net oil realisation for the nomination fields will rise, equity research firm HDFC securities said in a recent report. It, however, added there are multiple overhangs for the company.

"The popular consensus for crude prices is that they will remain muted in the near term owing to shale oil supplies in the US, rise in output in Iran and a persistent focus on market share by the OPEC. ONGC Videsh (OVL) and joint venture profits are directly linked to oil prices. Even ONGC profits will fall below the crude prices of $60 per barrel," the report said.

For Cairn India, an arm of the metals and mining giant Vedanta, the drop in crude prices translated into a 50 per cent decline in net profit at Rs 348 crore in the June quarter. Total income also dropped 41 per cent to Rs 1,619 crore. The company had in March announced a 58 per cent cut in capacity expansion for the current financial year to $500 million. While announcing the June quarter results, Cairn India's Chief Executive Mayank Ashar had said "optimisation in capital cost of projects to improve economic viability in a low oil price scenario" was among the key highlights during the quarter.

Experts said the latest rout in crude prices also provides an opportunity for companies to recalibrate their portfolios by investing in acquiring assets.

"OVL, for instance, has piled up a lot of assets (oil and gas blocks), which are in the exploration phase, at high prices. But the success has not been very good. This may be the right time for recalibration," said a senior analyst from an accounting and consultancy firm.

)