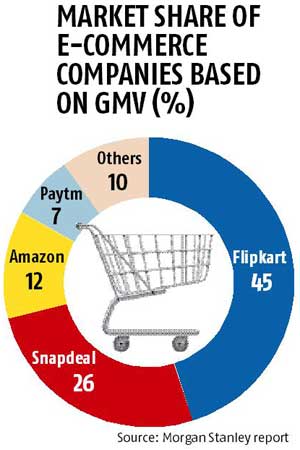

Online marketplace firms Flipkart and Snapdeal have managed to keep their top spots with a combined gross merchandise value (GMV) market share of 71 per cent, according to global brokerage firm Morgan Stanley.

GMV or gross merchandise value for e-commerce companies means sale price charged to the customer multiplied by the number of items sold.

According to the report, Flipkart bagged the top spot, with a GMV market share of 45 per cent, while Snapdeal came in second, with 26 per cent. The report puts Amazon India at number three, with a GMV share of 12 per cent.

“The e-commerce market was dominated by the three large general merchandise companies in 2015, with a combined GMV market share of 83 per cent. It will be interesting to see how these market shares play out in 2016 as Snapdeal, Amazon and Paytm have all raised their competitive intensity to close the gap with Flipkart,” it said in its report.

The report says combined GMV of Flipkart, Snapdeal, and Amazon, stood at $13.8 billion in 2015, while that of the top-10 offline retailers was $12.6 billion.

According to Morgan Stanley, Shopclues was the most capital-efficient (GMV to total capital raised) online marketplace, followed closely by Snapdeal and Paytm.

The report said $6.6 billion in venture capital and private equity investment was pumped into the country last year — an increase of 50 per cent over 2014 — which probably contributed to a steep growth in the gross merchandise value of e-commerce companies.

“We now increase our 2020 estimate of India’s e-commerce market from $102 billion to $119 billion. This takes our estimate of the total Indian internet market size from $137 billion to $159 billion, which also includes online food aggregation business,” it said.

The report said despite the high levels of deal activity in the Indian internet space, the latter witnessed consolidation and shutdowns. Some examples of consolidation were CarWale/CarTrade (automobile classifieds), Commonfloor/Quikr (real estate classifieds), TaxiForSure/Ola Cabs (taxi aggregators), and FreeCharge/Snapdeal (online recharges).

“Some companies, such as TinyOwl (food delivery) and LocalBanya (online grocery), shut part or all of their operations. While some of these actions could have been a result of an inability to raise new funds, we believe these are healthy developments, as they should help investors identify the dominant companies as the landscape evolves,” the report said.

It also said that higher internet penetration, a rise in the number of online shoppers, and an increase in per-capita income would help boost the e-commerce sector in India.

“Currently, India has the second-largest internet population in the world. We expect internet penetration to increase from 32 per cent in 2015 to 59 per cent in 2020, translating to a near-doubling of the internet user base,” it said. The report expects the number of online shoppers in India to grow to 320 million by 2020 from 50 million in 2015.

)