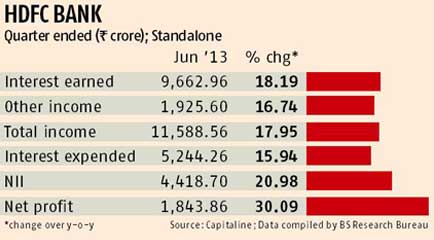

HDFC Bank, second largest private sector lender in the country, today said its net profit for the quarter ended June rose a little more than 30 per cent over the same period last year, to Rs 1,844 crore. Higher interest income, rise in other income, lower provisioning and stable margin helped.

It was the 55th quarter of 30-plus per cent year-on-year growth in the bank’s quarterly profit after tax, say analysts. Net interest income, the difference between interest income and expense, was Rs 4,419 crore, up 21 per cent from a year earlier. The net interest margin (NIM) was stable at 4.6 per cent. The bank expects NIM to stay at 4.1-4.6 per cent in the coming quarters. “It is a challenging environment, with moderate economic growth. We have done well with a stable margin and reasonably healthy asset quality,” said Paresh Sukthankar, executive director.

Other income rose 17 per cent from a year before, to Rs 1,926 crore. Operating expenses were up 15.7 per cent year-on-year. The bank improved its cost-to-income ratio to 47.9 per cent. Stable asset quality allowed a reduction in provisioning to Rs 527 crore in the April-June period from Rs 582 crore a year earlier. The gross non-performing asset (NPA) ratio was unchanged from a year before at one per cent, while the net bad loan ratio rose marginally by 10 basis points to 0.3 per cent. The bank has seen some slippages in commercial vehicle and construction equipment loans. Some corporate loan accounts also turned NPA during the quarter.

“Although there is no surprise in profit after tax with 30 per cent year-on-year growth, balance sheet quality did see some pressure during the first quarter...However, we believe NPAs in percentage terms remained within the management guidance (expectation),” said Saday Sinha, banking analyst with Kotak Securities. The total of restructured loans, including applications received and under process, were 0.2 per cent of gross advances at the end of the quarter. Advances increased by 21 per cent from a year before, to Rs 258,589 crore. Loan growth was driven by a 25.5 per cent rise in retail advances and 16.5 per cent increase in corporate loans. Retail advances had a 54 per cent share in the overall loan book. Total deposits grew 17.8 per cent to Rs 303,315 crore.

He ruled out the possibility of a rate cut, as liquidity is expected to remain tight in at least the near term. The bank closed the quarter with a capital adequacy ratio of 15.5 per cent and a tier-I capital ratio of 10.5 per cent as in Basel-III guidelines.

)