The Prem Watsa-founded Fairfax Financial Holdings will increase its stake in ICICI Lombard General Insurance by nine per cent for Rs 1,550 crore. The deal, expected to be closed by March, will take Fairfax’s stake in the company to 35 per cent, while the remaining stake will be held by promoter ICICI Bank.

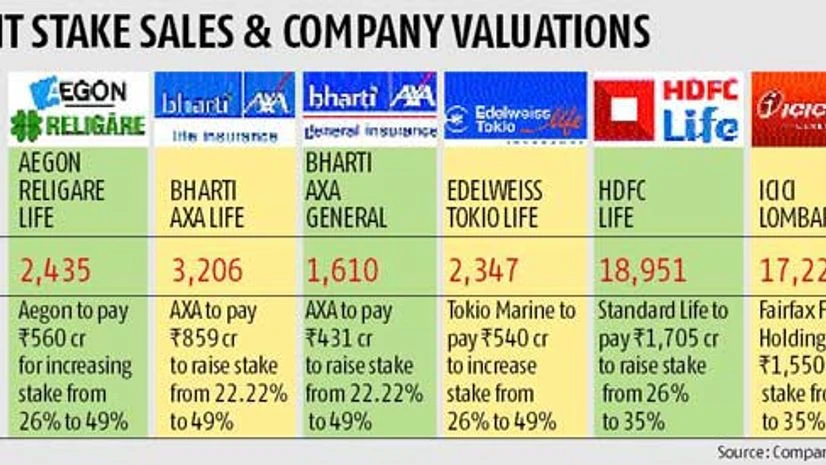

The deal values the general insurance company at Rs 17,225 crore.

Earlier this year, the government approved the increase in the foreign direct investment (FDI) ceiling in the insurance sector from 26 per cent to 49 per cent. However, ownership and management control has to remain with domestic promoters.

“The transaction is at a very good value and reflects the company’s franchise as a leading private sector general insurance company in India and also the substantial potential for profitable growth of the business,” Chanda Kochhar, managing director and chief executive officer of ICICI Bank, said during a conference call, while announcing the bank’s September quarter earnings.

“I think it is not the question of option. Our joint venture agreement was on the basis of 74:26 holding. The fact that they have picked up an additional nine per cent shows that they have full faith in the franchise and its potential,” Kochhar said, when asked why the foreign partner had raised its stake by only nine per cent.

ALSO READ: ICICI Bank net up 12% on retail loan growth

The insurer will now have to make an application to the Foreign Investment Promotion Board for the increase in stake.

ICICI Bank, however, ruled out an initial public offering (IPO) for its general insurance arm. “As of now, there are no plans. As we said earlier, we were looking to monetise the asset, which we have done,” Kochhar said, and added that the bank would also look at monetising its holding in the life insurance company ICICI Prudential. ICICI Lombard, set up in 2001, has almost doubled its valuation in the past five years on healthy premium growth. “While they have been strong in motor and health insurance, other segments of the business have also seen a good combined ratio,” said an insurance industry consultant.

ICICI Lombard is the largest private sector general insurance company and had a net earned premium of Rs 1,220.25 crore in the September 2015 quarter.

In August this year, Standard Life had said it would buy a nine per cent additional stake in its Indian insurance venture HDFC Life, taking its stake to 35 per cent. This deal had valued HDFC Life at Rs 18,951.4 crore.

)