Tata Motors' stellar growth in a declining market can be fully attributed to the continuing surge by its cash-rich subsidiary Jaguar-Land Rover (JLR), despite the Mumbai-based company marking 2013 as one of its worst years.

UK-based JLR posted 16 per cent growth in retail sales in the past year, highest in the luxury car segment globally, on the back of launches, output ramp-up and better reach in world markets.

Much of that growth came from China, which bought one in every four cars made by JLR. Beating the UK, China has become the largest market for JLR, which reported profits beyond analysts' estimates repeatedly in the earlier quarters of the past year.

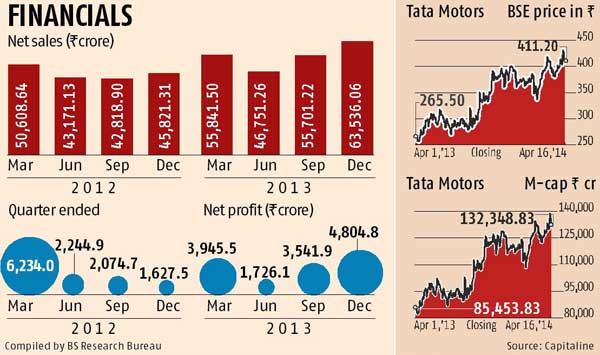

Tata Motors' shares shot up by half in FY14 and was third among the top five wealth creators on the BSE Sensex. JLR constituted 83 per cent of the total revenue and 90 per cent of the net profit of Tata Motors' consolidated financial numbers as of December. Demand for each of its new models, such as the Range Rover Sport, Range Rover Evoque, Jaguar XJ and Jaguar F-type, have beaten expectations.

"We continue to have for JLR good market pull for all our products, particularly the recently launched Evoque continues to have a good run. Range Rover and Range Rover Sport continue to have long weeks of wait for consumers," C Ramakrishnan, chief financial officer, said during a recent conference call.

The robust demand has forced Tata Motors to keep the three JLR factories in the UK running round the clock, a first in that country in recent years.

Back home, Tata Motors is bearing the brunt of a demand slowdown. Its market share in passenger cars has dipped to a new low of under six per cent. The commercial vehicle segment is also also struggling with sales of medium and heavy trucks dipping to a decade's low, forcing Tata Motors to lay off workers and operate plants at less than 50 per cent capacity.

The company's passenger vehicle sales for the year ended March slumped 37 per cent from the prior year to 198,000. The dip was far higher than the industry, where sales fell six per cent. Commercial vehicle sales, too, fell by 29 per cent last year.

New initiatives

Though the slowdown has hit profitability, it has also provided Tata Motors the opportunity to tighten its belt and make its operations leaner. This coupled with a series of new launches, including under the Tata brand, help to lower risks.

A new hatchback and a sedan, Zest and Bolt, will be launched in the coming weeks by the company. New models and variants of trucks and buses are also set to hit the market in the coming months. The troubled car Nano will continue to see alterations done to it, which could include a new engine.

The pace of new launches at JLR is expected to remain robust this year, too. The premium brands are set to lower their entry price and have models in the sub-Rs 30 lakh category with compact models coming from both Jaguar and Land Rover.

Further, new factories in China and Brazil will over the next 18-24 months take JLR's global production capacity to 700,000 from 450,000-500,000 now. A plant in Saudi Arabia is in the pipeline, beside an increased focus on the India factory.

A report from JP Morgan says Tata Motors will raise expenditure to £3.5 billion in 2014-15, given its investments in new technologies and capacity as well as network expansion. "The investments in the passenger car business are now visible, given the rollout of the new Revotron gasoline engine as well as the launch of the new Bolt and Zest passenger cars,"it says.

However analysts highlight that Tata Motors is heavily dependent on JLR and caution against any slowdown in the business. Further, back home, subdued demand for commercial vehicles for two consecutive years with no clarity on an expected revival has put a question mark on Tata Motors domestic operations.

)