Mired in controversy, the Rs 2,060-crore deal between Jet Airways (India) Ltd and Abu Dhabhi-based Etihad Airways is proving to be a trap for large investors (both foreign and local), who had been betting big on the deal by increasing their stakes in the former.

Talk of the deal was brewing since the beginning of the year. Investors flocked towards the galloping counter as Etihad had agreed to pay over 30 per cent premium for acquiring a 24 per cent stake in the Indian company.

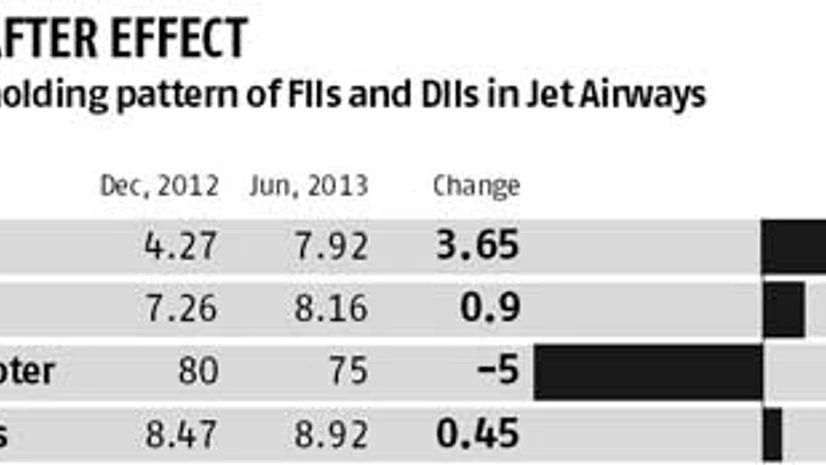

Foreign institutional investors scaled up their holdings in Jet from 4.27 per cent in December 2012 to 7.92 per cent as on June 30, while domestic institutional investors increased their exposure by around a percentage point to 8.16 per cent.

All this happened during a period that saw Jet's promoter Naresh Goyal diluting his stake in the company from 80 per cent to 75 per cent. And, the average price of the Jet stock hovered around Rs 550 apiece.

The counter hit its 52-week high of Rs 688 the next day of the deal announcement. However, what followed later was beyond anybody's imagination. In a matter of less than three months, Jet's shares are down 46 per cent since its year-high figure, mainly due to the numerous hurdles the deal is facing.

But nothing could stop the falling share prices of Jet.

On Monday, the stock of Jet closed 0.6 per cent higher at Rs 372.05 on the Bombay Stock Exchange, while the benchmark Sensex gained 0.05 per cent to 20,159.12. In the previous financial year, the company had reported a net loss of Rs 485.5 crore, while its revenue stood at Rs 16,852 crore.

)